Brought to you by your Trade Compliance Friends.

BIG NEWS FOR SMEs!

Win or lose at the Supreme Court, Trump has other options to use on tariffs. Small Business RELIEF Act would exempt small businesses from tariffs and provide refunds for duties already paid.

In today’s sub-chapter:

📜 Trump has other tariff tools to use, like Section 232 and Section 301

💵 Under the Small Business RELIEF Act, Trump has 90 days to refund small businesses for any tariffs already paid

❌ Trump boycotted the G20 summit in South Africa

🚢 Global maritime growth is slowing

IF PLAN A DOESN’T WORK…

Trump’s plan A: win the SCOTUS hearing on his sweeping tariffs. Keep his IEEPA powers. Continue imposing tariffs like nothing had happened.

What if he loses? The gov’t could be forced to refund hundreds of billions in tariffs to U.S. businesses.

But will that be the end of tariffs? Don’t get your hopes up! Trump has a plan B. According to experts, here are some other tariff tools he could use.

Section 232

Seems to be Trump’s favorite. Section 232 of the Trade Expansion Act of 1962 applies when imports threaten national security. Trump has aggressively used 232 to impose tariffs on various goods, including foreign steel and aluminum, cars, copper, timber, and kitchen cabinets.

Since the definition of national security is so broad, the White House was able to expand the lists to include many derivative goods, like bathroom vanities. And Trump seems to be targeting more sectors, like semiconductors, critical minerals and derivatives, robotics, industrial machinery, and medical devices. Wait, gloves are now a national security threat? Okay.

These and other sectors are being investigated, and we know they can find something if they want to. And don’t hope for any relief because there’s no rollback.

So yes, Section 232 seems to be the plan.

Section 301

Under Section 301 of the Trade Act of 1974, Trump can target goods if a country’s unfair trade practices harm U.S. commerce. For example, the U.S. Trade Representative recently initiated a Section 301 investigation into China’s implementation of its “Phase One” trade commitments.

Section 201

Also from the Trade Act of 1974, Section 201, or safeguard tariffs, allows the president to grant temporary import relief if the U.S. International Trade Commission (ITC) finds that a surge in imports is causing or threatening serious injury to a U.S. industry. These were used against China in Trump’s first term for IP theft and forced technology transfer.

Section 122

Section 122 allows the president to impose tariffs of up to 15% for as long as 150 days in response to unbalanced trade. No investigation is needed. However, Section 122 has never been used before, and there’s a lot of uncertainty about how it would work in practice.

Section 338

Section 338 of the Tariff Act allows the president to impose tariffs up to 50% or block imports from countries that discriminate against the U.S. Just like Section 122, it hasn’t been used before and requires no investigation. Also, it has no time limit on how long the tariffs can stay in place.

But it has a poor reputation, and it has been widely criticized by historians and economists for restricting global trade and worsening the Great Depression in 1930. Will Trump be the first president ever to use it?

Is Trump going to love these tools?

Yes, but probably not as much as his IEEPA tariffs. These options are more limited in scope, slower, and harder to implement. For example, Section 301 usually requires a lengthy investigation, while Section 122’s 150-day limit makes enforcement very challenging. These tools are definitely going to test Trump’s patience and persistence, but he seems to be fond of them, especially Section 232 and 301.

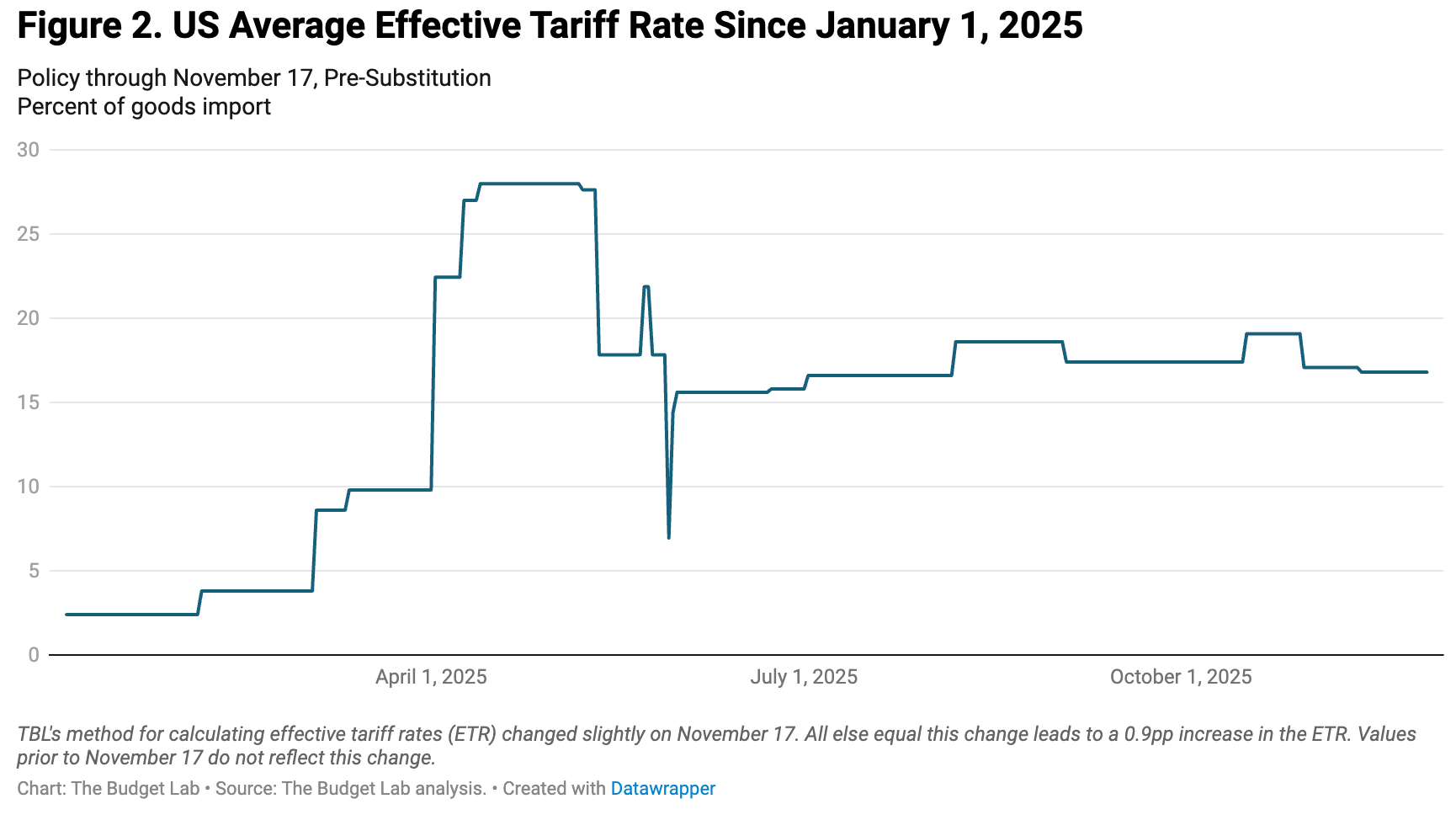

It’s also worth noting that revenue potential from these tools is much smaller. Yale’s Budget Lab projects that if the IEEPA tariffs stay in place, total tariff revenue from all of Trump’s 2025 tariffs could be $2.7 trillion over 2026–2035, but if IEEPA tariffs are removed, that falls by about half. Average effective tariff rates increased sharply this year, and IEEPA tariffs have driven that surge.

Source: Yale’s Budget Lab

To raise revenue in 2026, Trump might leverage Section 301 to impose tariffs on key trading partners. But again, these tariffs can’t be applied instantly, so I don’t think it would bring in anywhere near the same money as his IEEPA tariffs.

But yes, tariffs are here to stay. And with the Supreme Court’s decision still pending, the business community and U.S. trading partners remain in limbo, waiting to see the next move. Trump may lose, or the justices may side with him. But one thing is clear: tariffs will always be a key part of his trade agenda.

But even if IEEPA tariffs are invalidated, existing strategies shouldn’t be derailed. Trade will continue, and while rules and policies may evolve, diversification and resilience will always be more important than ever.

“COLLATERAL DAMAGE” IN THE TRADE WAR

Small businesses have been squeezed by Trump’s tariffs, and lawmakers are now pushing for relief. Senator John Hickenlooper and Representative Kelly Morrison introduced the Small Business RELIEF Act, which would exempt small businesses from paying these tariffs going forward and require refunds for duties already paid. If the bill is enacted, Trump has 90 days to settle the refund.

Hickenlooper called the tariffs “collateral damage” in the trade war. According to the U.S. Chamber of Commerce, there are 236,045 small‑business importers (under 500 employees), which make up 97% of all U.S. importers. And according to a Small Business Majority survey, 60% of small businesses experienced higher costs due to tariffs.

But will the RELIEF Act actually go anywhere when earlier efforts, like the Small Business Liberation Act, failed? And now that Trump’s IEEPA tariffs are tied up in the courts, and billions of dollars in tariffs could be refunded to importers, will lawmakers push to approve the relief and make the gov’t lose even more revenue?

Plus, if it becomes law, how quickly would refunds reach eligible companies? And would there still be enough money left to cover everyone affected in the first place?

QUICK HITS ON GLOBAL TRADE

☎️ Trump Asks Xi to Speed Up Goods Purchases. Trump says Chinese President Xi “more or less agreed” to increase US goods purchases after their recent phone call, which Beijing described as “positive, friendly and constructive.” This comes after China pledged last month to resume soy bean purchases and ease restrictions on rare earth exports to the U.S. Trump reportedly said, “I asked him, I’d like you to buy it a little faster. I’d like you to buy more”.

🇪🇺 US Urges Europe to Rethink Tech Rules for Lower Tariffs. US Commerce Secretary Howard Lutnick urged Europe to reconsider its digital regulations if it wants lower US tariffs on steel and aluminum. European officials expected lower tariffs on metals under the summer deal, but the US still charges 50% and added more products to the levy. They also hope to get exemptions for items like wine, cheese, and pasta, similar to previous rollbacks for tropical fruit and coffee.

🇨🇦 Canada Acts to Boost Steel and Lumber Industries. Canada imposes a 25% tariff on certain steel products, cuts import quotas, and ends temporary tariff remissions by Jan. 31, 2026. Freight rates for steel and lumber drop 50% in Spring 2026. $100M supports workers, while $1B aids businesses and boosts domestic demand.

🇧🇷 U.S. Drops Tariffs on Brazilian Agricultural Goods. An executive order issued last Thursday removed 40% tariffs on Brazilian beef, coffee, and 238 HTSUS-classified agricultural products effective Nov. 13, 2025. CBP guidance adds 11 new exempt categories. Importers must declare HTSUS 9903.01.81 or 9903.01.90 and correct prior entries.

SAVE THE FURNITURE

The Empty Chair Summit.

U.S. President Trump was a no-show at the 2025 G20 Johannesburg summit held in South Africa. He urged the leaders not to sign the final declaration, but they signed it anyway.

“The declaration, using language to which Washington has been opposed, can’t be renegotiated,” South African President Cyril Ramaphosa said.

It’s as if the world leaders are saying, “The world can move on without the U.S.”

Is this a sign that countries are growing tired of the uncertainty created by U.S. shifts on major policies like trade? Has Trump’s no-show created space for other global partners to explore trade opportunities with other countries?

For example, Canada held talks with Vietnam’s Phạm Minh Chính, the incoming CPTPP chair, and European Commission President Ursula von der Leyen on new investment opportunities.

Australia’s Prime Minister Anthony Albanese said that the summit was still relevant and that the best thing to do is to “save the furniture.” He said, “The best we can do is save as much of the furniture as we can and to look for arrangements which are bigger than regional and short of global.”

South Africa has officially handed over the G20 chair to the next host, which happens to be Trump. Makes me wonder… Is Trump going to invite the South African president? Or will we also see another empty chair at the 2026 summit?

WHO CARES?

When asked at the G20 summit when he last spoke to President Trump, Canadian Prime Minister Mark Carney simply said, “Who cares? I mean, it's a detail. I spoke to him. I'll speak to him again when it matters."

This dismissive comment irked conservative MPs, who think it shows Carney is not taking the tariff fight seriously. Leader Pierre Poilievre said, “We care about the workers who have lost their jobs and don’t have paychecks to make their mortgage payments. Why doesn’t he care?”

Under pressure, Carney apologized, calling it a poor choice of words.

What was in Carney’s mind when he made the remark? Was he signaling that the timing of discussions with Trump wasn’t urgent? Or was he prioritizing trade talks with other partners rather than yielding to U.S. pressure? And how does this sentiment affect the upcoming CUSMA review in 2026?

Trump ended trade deals with Canada last month over an anti-tariff ad featuring former President Ronald Reagan. He said he has no immediate plans to meet Carney, but the Prime Minister is considering traveling to Washington next week for a FIFA World Cup event. Is he planning a side trip to try and reopen trade talks with Trump?

STORMY SEAS

According to project44’s State of Ocean Transit Report 2025, global container volumes dropped 13% through October 2025 compared to last year, with a sharp 27% decline on the China-U.S. trade lane.

Source: project44

This aligns with UNCTAD’s Review of Maritime Transport 2025, which notes that maritime growth is slowing and that tariffs and trade disruptions are major factors affecting global shipping efficiency.

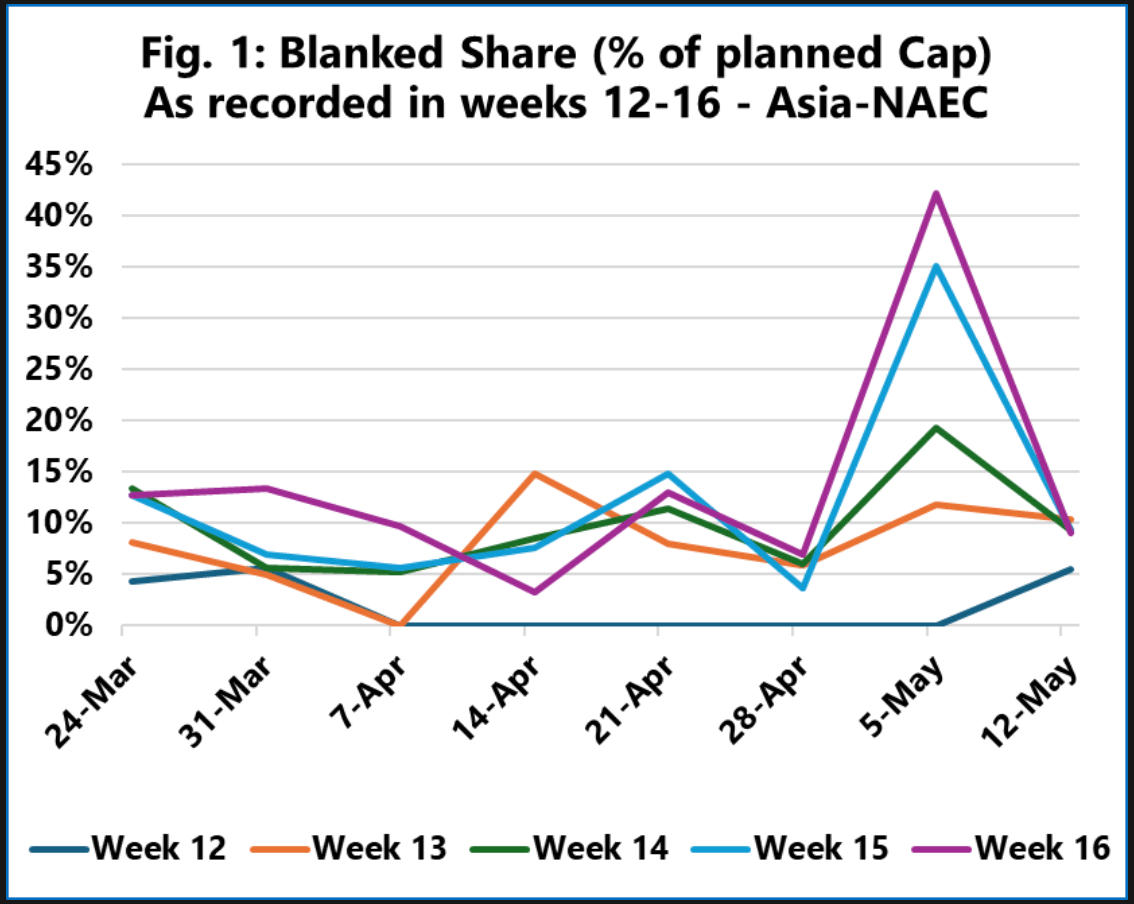

Blank sailings surged in 2025, especially on key routes involving the U.S. and China-Europe lanes. And tariffs have a direct impact. In fact, according to Sea‑Intelligence, U.S. tariffs caused Transpacific blank sailings to rise rapidly in early May 2025. This shows how major trade lanes, such as Transpacific and China–Europe, are highly sensitive to policy changes.

Source: Sea‑Intelligence

On the good side, we’re seeing some resilience. U.S. imports from Indonesia and Thailand rose over 30% as companies diversified away from China. Again, this just shows that diversification will always be an essential response to reduce reliance on single trade routes and mitigate the impact of tariffs and delays.

So, looks like global trade hasn’t collapsed after all. Companies continue to adapt to changing policies and market conditions.

TOO MANY SHIPS, TOO FEW CONTAINERS?

In her latest Freight Forward article, Cathy Morrow Roberson shares key updates in supply chains. Ocean freight is slowing, with North Europe–to–U.S. East Coast shipments dropping and European ports facing congestion. OOCL is adding Halifax to its trans-Atlantic route, and Zim plans to resume Suez Canal shipping, which may affect freight rates.

Follow Cathy on LinkedIn for more supply chain and global shipping insights.

Source: Cathy Morrow Roberson (LinkedIn)

FINALFINALTARIFFS.DOC

Waiting for the “final_please use this_final.doc” version 🤣

Source: Jeva Lange (Bluesky)

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!