Brought to you by your Trade Compliance Friends.

Supreme Court appeared skeptical of Trump's tariff arguments yesterday. Learning Resources CEO said the lawsuit is expensive, but suing was a necessary cost.

In today’s sub-chapter:

⚖️ Learning Resources, Inc. vs Trump (Tariffs)

🤝 U.S. and China reached a landmark trade deal

👟 Adidas is losing 120 million euros to Trump’s tariffs this year

⌚ CBP seized counterfeit luxury watches

RUH, ROH! IS TRUMP’S FAVORITE FOREIGN POLICY TOOL IN TROUBLE?

After listening to over 2 ½ hours of SCOTUS oral arguments yesterday, I suspect the justices weren’t fully buying Trump’s legal justification on his IEEPA tariffs.

Chief Justice John Roberts, who interestingly called the tariffs “taxes”, said that the imposition of taxes on Americans has always been Congress’s core power. Justice Amy Coney Barrett questioned whether there’s any other time in history where “regulate … importation” has been used to impose tariffs.

But other justices seemed to have sympathized with Trump’s tariffs. Justice Kavanaugh repeatedly referenced Nixon’s 1971 global 10% tariff under TWEA. Justice Alito pointed out that Trump could re-impose nearly all the tariffs under Section 338 of the Tariff Act, which, to me, is almost saying that the Court should just leave the IEEPA tariffs alone.

Amy Howe, co-founder of SCOTUSblog, says the justices’ tone suggests that the Court may rule against Trump’s tariffs. I wouldn’t be surprised if SCOTUS rules against Trump, since the ability to declare an emergency is vague, but I also wouldn’t be shocked if they side with him, like they did on other contentious cases this year.

If I had to guess (and I’m no lawyer), I’d say a 6-3 ruling against Trump, although predicting from the arguments is foolish. In fact, a study found that Supreme Court justices ask more questions of advocates whom they ultimately vote against.

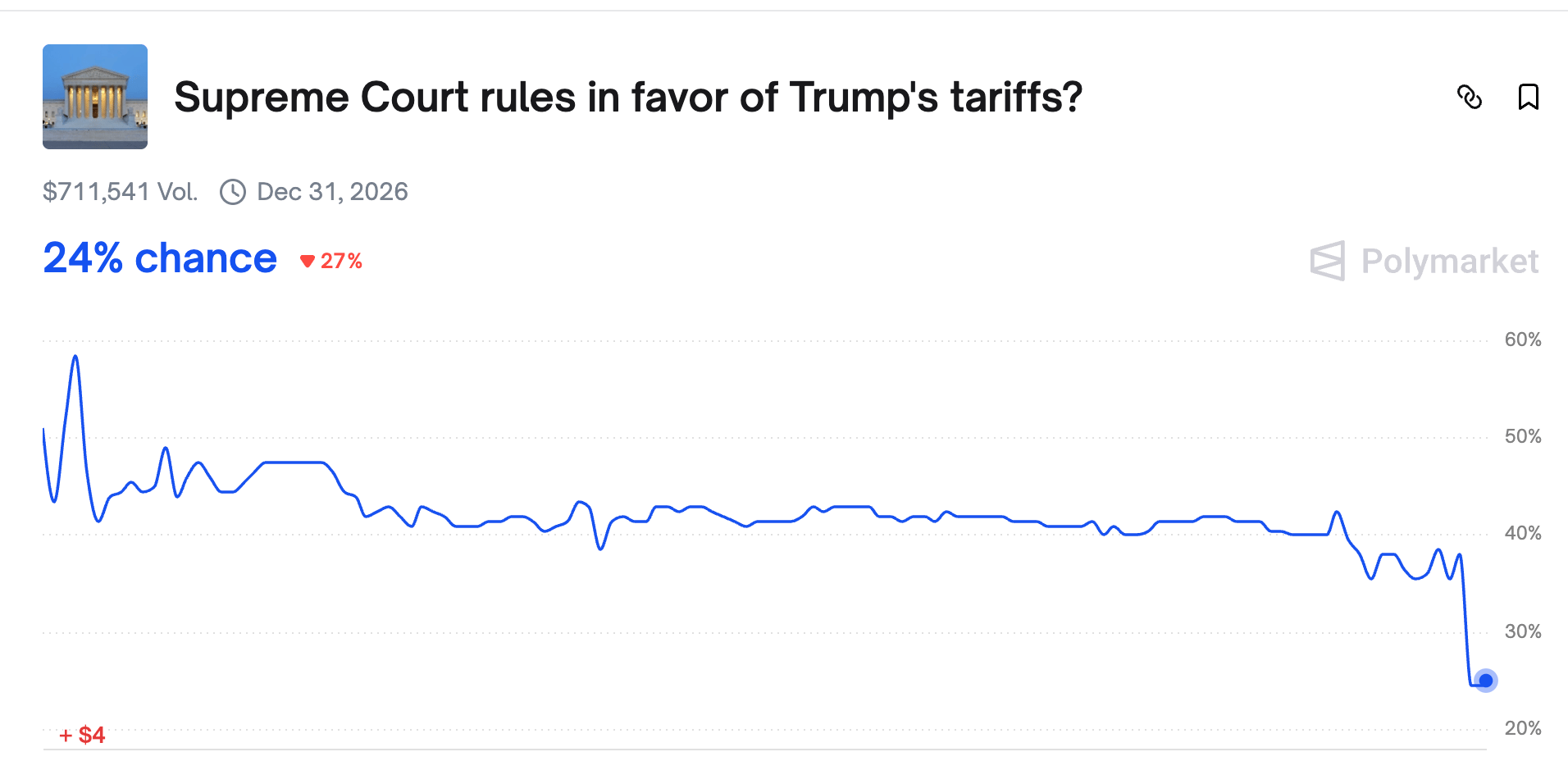

In fact, even the markets are leaning that way. On Polymarket, the odds of the Court siding with Trump’s tariffs just dropped to around 24% as of this writing. It’s been sliding for days, which probably says a lot about where sentiment is heading.

Source: Polymarket

That said, the hearing gives a crumb of hope to the tariff challengers, led by an educational toy company, Learning Resources. The Court is now drafting its opinion, and we might have to wait until this winter or early spring at the latest, though the Trump administration asked the justices to move quickly in this case.

What Happens Next?

If Trump loses, he will likely use other tools to impose tariffs. But the ruling against his tariffs would be a major blow to his economic agenda. Wells Fargo analysts say that about $90 billion in import taxes have already been paid. Trump officials warn the total could rise to $1 trillion if the Court waits until June to issue a ruling. Can the Court rush out an opinion before that figure balloons higher?

But if he wins, what does it mean for his and future presidents’ powers? Will Trump take the approval as a green light to think his power over tariffs is limitless? Will he further leverage tariffs as a pressure point and bargaining chip in trade negotiations?

As Justice Gorsuch said, if the Court grants a president this authority, what would stop a future president from declaring a “climate emergency” and imposing a 50% tariff on gas-powered cars? Which is true.

Refund Would Be A “Mess”

Barrett cautioned it would be a logistics “mess” if the tariffs are ruled illegal. (I hope this won’t affect the Court decision). The refund process may require a lot of extra work for importers and the administration, but it shouldn’t factor into how the justices rule.

And for businesses that outsource customs paperwork, refunds could first go to third-party brokers and require extra approvals. Some Wall Street banks were reportedly arranging deals allowing investors to buy potential tariff refunds at a discount, giving businesses upfront cash and investors a chance to profit if SCOTUS rules the tariffs unlawful. So there’s that option.

At the end of the day, we can’t really tell what will happen in the SCOTUS decision. The stakes are huge for Trump. The Court seems very skeptical, and experts and markets seemed pleased. This may be a good sign. Maybe.

Hopefully, a SCOTUS decision will come sooner for the sake of American households and small businesses who are currently paying for the tariffs one way or another.

After all of this…will Trump still call tariffs “the most beautiful word? Hard to say he won’t, as he seems to always have a plan B.

WORTH THE COST

SCOTUS heard arguments on Trump’s tariffs yesterday, and it was a high-stakes moment for a group of small businesses, led by Learning Resources. CEO Rick Woldenberg said that he had to cancel a 600,000-square-foot expansion, freeze new hires, and scale back spending because of Trump’s tariffs.

Source: Learning Resources

His bill on the lawsuit is in the millions of dollars, but Rick said he felt it was worth the cost. It’s a risky move, but these companies aren’t going down without a fight. If the Court strikes down the tariffs, Learning Resources and other small businesses could get back what they’ve lost. If not… well, we can only imagine the impact.

But no matter the outcome, we do hope this becomes a “lesson learned” for policymakers. We need a clearer, more transparent approach to trade and tariffs, with non-negotiable limits on presidential powers and unmistakable guidance on when and how tariffs should be used.

P.S. If you want to support Learning Resources during this challenging time, check out their website and see if you can find something for your kids.

QUICK HITS ON GLOBAL TRADE

🤝 U.S. and China Reach Landmark Trade Deal at APEC 2025. China will suspend export controls on rare earths and critical minerals, halt fentanyl precursor exports, remove retaliatory tariffs on a wide range of agricultural and food products, and resume soybean purchases. The U.S. will lower IEEPA tariffs on fentanyl-related imports by 10%, extend Section 301 exclusions, and suspend select regulatory actions.

🖥️ Nvidia’s Top AI Chips Can’t Go to China & Other Countries. President Trump said in a "60 Minutes" interview that Nvidia’s top Blackwell AI chips will go only to U.S. companies, blocking China and other countries. South Korea will receive shipments, and a lower-end version could go to China, but Trump said, "We will let them deal with Nvidia but not in terms of the most advanced.”

🚢 US and China Suspend Port Fees for One Year. The U.S. and China have agreed to suspend tit-for-tat port fees on each other’s vessels for one year. These fees were imposed in response to escalating trade tensions, which have greatly affected shipping, logistics, and maritime trade flows. However, it’s still unclear when the pause takes effect and what will happen to the fees already paid by ship operators.

🙂 Trump Signals Trade Thaw with Canada. U.S. President Trump described his recent meeting with Canadian PM Carney in South Korea as a “very nice conversation.” The comment came after tensions over what Trump called a “fraudulent ad” involving remarks of former U.S. President Ronald Reagan. Carney said Canada is ready for trade talks whenever the U.S. engages.

🇨🇦 Canada Doubles Down on Trade and Investment in 2025 Budget. Canada’s 2025 federal budget sets a strong focus on trade, investment, and industrial growth. The plan launches a $5 billion Trade Diversification Corridors Fund, aims to double overseas exports, and creates a single export support hub, which leverages Canada’s unmatched free-trade access across all G7 economies to boost manufacturing and construction.

I’LL PASS ON SAMBA FOR NOW!

I wanted another pair of Samba sneakers, but now I’m not so sure.

German sportswear giant Adidas CEO Bjorn Gulden said the company could lose 120 million euros (~$129 million) to Trump’s tariffs this year. He added that “nervous” U.S. retailers are ordering less as they wait to see the full impact of tariffs on American shoppers.

Gulden said the company has avoided raising prices on its cheaper products, as customers are more sensitive to those increases. They instead raised prices on more expensive items, including the Samba OG Shoes, which is now, $100 up from $90.

So, what is Adidas’ game plan? The company is looking to invest in college sports, long dominated by Nike. But will it guarantee stronger sales in 2026? Hopefully, it will!

Either way, here’s what we see: these tariffs have become a new line item on the balance sheets of global companies. They’re affecting pricing and customer decisions and hurting companies’ bottom lines.

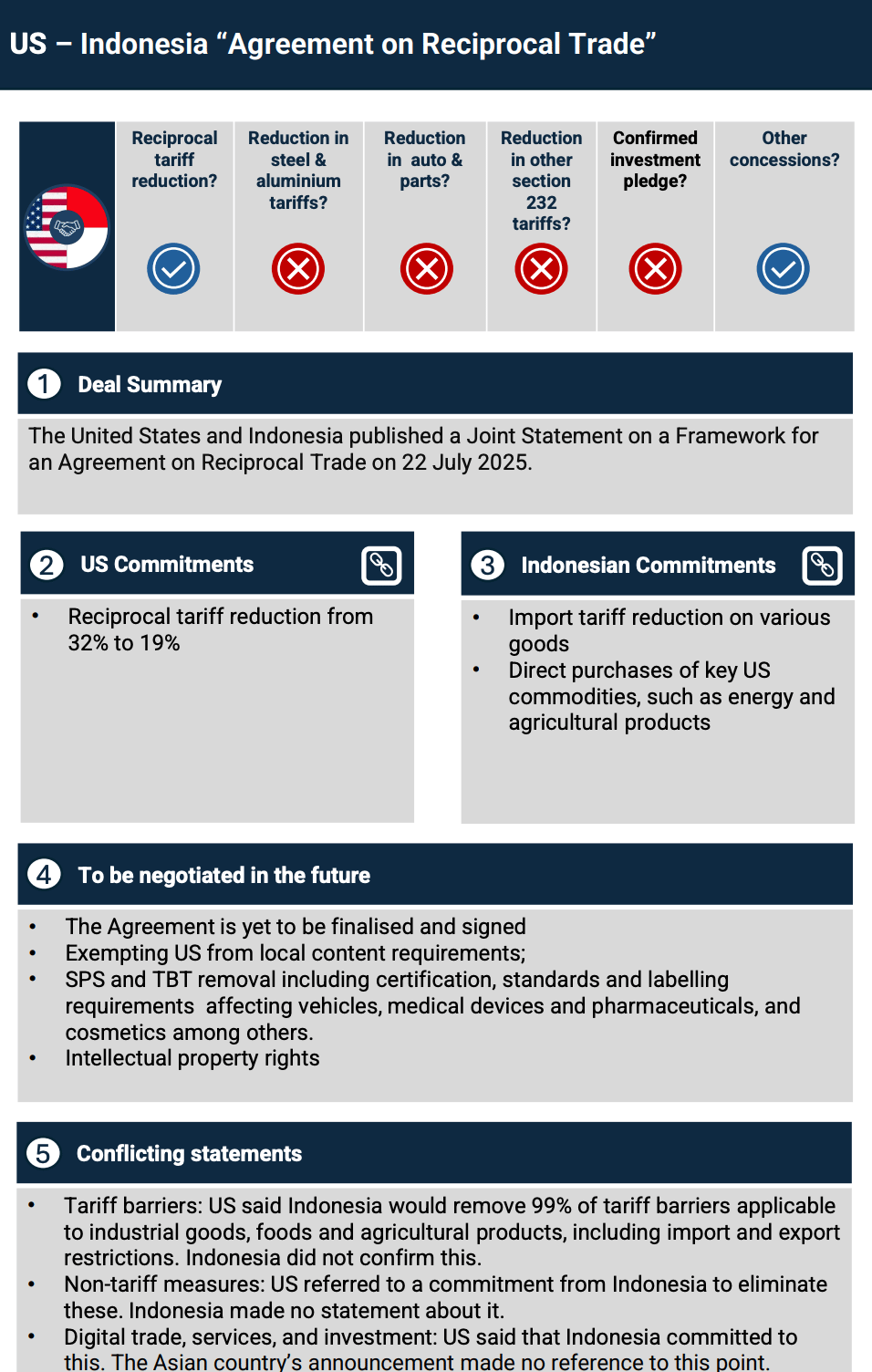

WAIT, WASN’T THAT TARIFF GONE ALREADY?

You’ve probably lost track of which tariffs are on, off, or back again.

Global Trade Alert’s latest downloadable Tariff Deals Booklet breaks down the latest deals in easy-to-read visuals. It compares each deal’s key commitments, tracks progress, and even flags conflicting statements. Only agreements with official statements from both sides are included, so you know the information is verified.

The booklet includes Trump’s latest trade deals with 4 ASEAN countries.

Source: Global Trade Alert

JUST GIVE THEM TO ME, I WON’T TELL ANYONE!

Louisville CBP recently seized two shipments from Hong Kong carrying 53 counterfeit luxury watches worth around $6.6 million if genuine. The haul included fake versions of Cartier, Rolex, and Hublot, bound for Union City (Georgia) and Doral (Florida), before being turned over to Homeland Security for investigation.

Again and again, this is a wake-up call for importers. Know who you’re sourcing from, verify brand authorizations, and work closely with your customs brokers to confirm documentation and product codes before clearance.

Now, it must be oddly satisfying to watch those fake watches get crushed. But a part of me wishes they could just hand me one, and I promise I wouldn’t tell anyone.

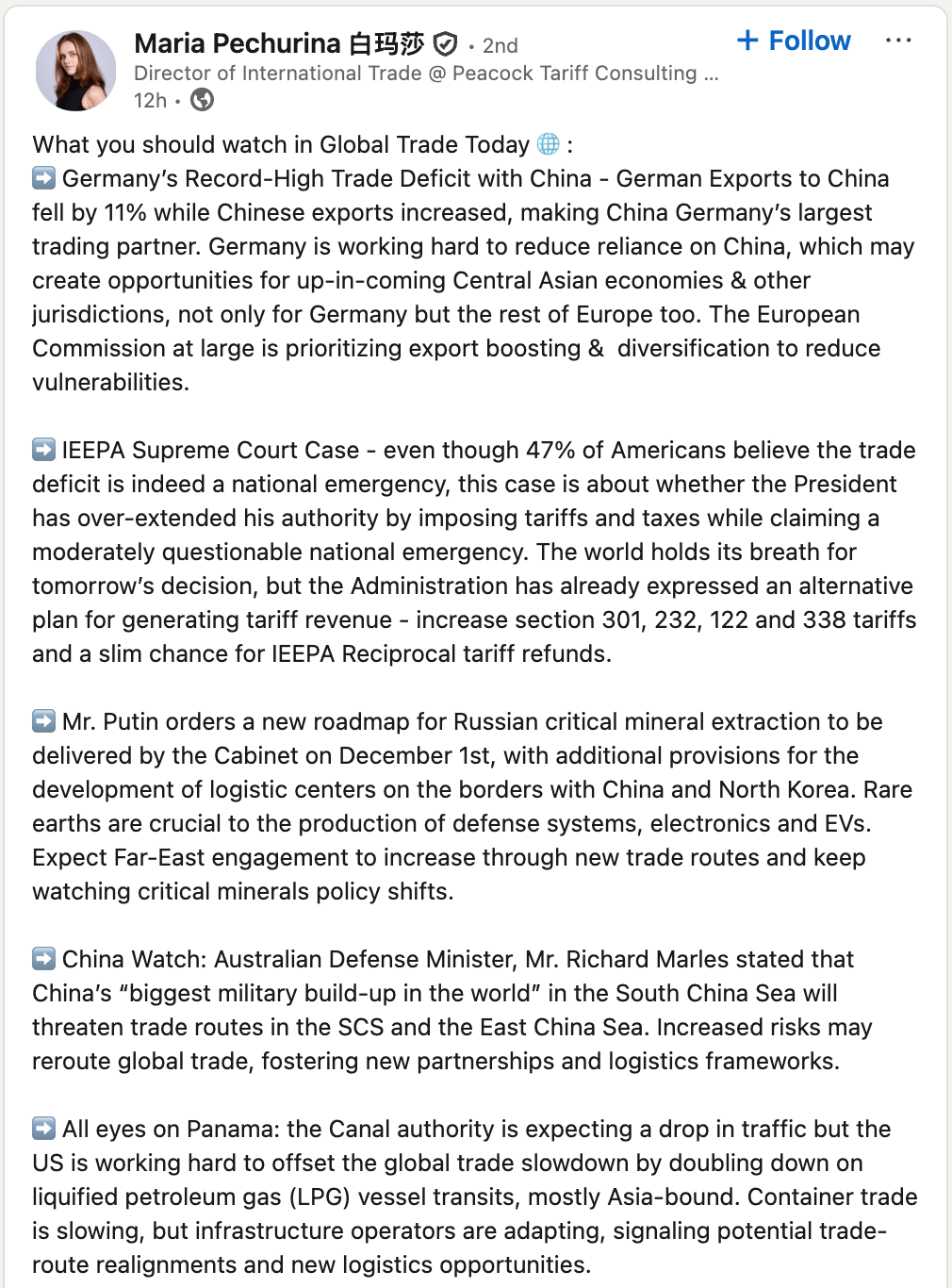

THIS LINKEDIN POST MADE US STOP SCROLLING!

If you want to stay on top of key global trade developments, Maria Pechurina’s LinkedIn post is worth checking out. We really like her takes on Germany-China trade, the IEEPA Supreme Court case, Russia’s minerals plan, China’s military moves, and Panama Canal traffic trends. Follow Maria Pechurina on LinkedIn for more insights.

Source: Maria Pechurina (LinkedIn)

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!