Brought to you by your Trade Compliance Friends.

A 100% tariff on pharma is coming on Oct. 1. More tariffs under Section 232 will hit trucks, lumber, and furniture, while foreign-made movies could also face a 100% duty.

In today’s sub-chapter:

💊 U.S. to impose 100% on branded and patented medicines

🚛 Section 232 extends to trucks, lumber, and wood furniture; duty drawback applies to furniture

🎬 Trump threatens 100% tariff on foreign-made movies

📦 A snapshot of the impact since the de minimis suspension

YOUR TARIFF HEADACHE RELIEVER IS GETTING TARIFFED!

Just as tariff headlines seemed to settle, President Donald Trump announced a new set of duties, including a 100% tariff on branded and patented pharmaceutical products, effective October 1, 2025.

In his social media post, Trump said the 100% tariff will hit branded and patented medicines unless companies are “building” new plants in the U.S., defined as “breaking ground” and/or “under construction.”

The tariff will affect many imported medicines, including those used by programs like Medicare and Medicaid, but generic medicines, including most from India, are currently exempt.

Some big companies, like Eli Lilly, plan to expand U.S. production, but new plants take time. Pfizer, meanwhile, secured a three-year tariff exemption by agreeing to lower U.S. drug prices and invest $70 billion in domestic manufacturing.

As of this writing, there’s no official guidance, leaving many questions. Some branded products no longer have patents, while others have patents but no brand name. And what about existing factories with no new construction plants? We need clarifications around these.

SECTION 232 IS TRUMP’S FAVORITE WAY TO IMPOSE TARIFFS!

President Trump recently announced new tariffs on several imported goods under Section 232, which is a legally supported method to impose tariffs without the complications of recent court challenges.

Heavy-duty trucks: 25% tariff, effective October 1, 2025

Softwood timber and lumber: 10% tariff, effective October 14, 2025

Kitchen cabinets, bathroom vanities, and upholstered furniture: 25% tariff, effective October 14, 2025. Tariffs will be eligible for duty drawback, unlike other Section 232 tariffs.

The lumber tariff is already official under a September proclamation, while the others are still awaiting final details.

So, how are these tariffs expected to affect key industries?

The truck tariff may raise fleet acquisition costs and increase shipping expenses, while the lumber duty may add roughly $720 to construction costs per home. Tariffs on cabinets and furniture could tack on another $280 to home costs, putting pressure on consumers and home improvement businesses.

QUICK HITS ON GLOBAL TRADE

🤝 U.S. Formally Implements Modified EU Trade Deal with 15% Auto Tariffs. The U.S. formally implemented the US-EU trade deal, retroactively lowering auto tariffs from 25% to 15% starting August 1, 2025. The deal exempts generic pharmaceuticals, all aircraft and parts, and scarce natural resources like cork from tariffs.

⚠️ EU Industry Warns of Expanding U.S. Steel Tariff List. The EU steel sector faces increased pressure as the U.S. considers expanding tariffs to "derivative" products like windows and doors containing metal. Business leaders warn that this rolling list adds uncertainty and costs, threatening European manufacturing and jobs.

🌱 Trade Tensions Weigh on U.S. Soybean Market. U.S. soybean prices have declined to approximately $10.13 per bushel as of Oct. 2, 2025, due to China's halt in imports amid ongoing trade tensions. Meanwhile, Canadian soybean prices remain higher, with Ontario bids around $13.10 per bushel, showing steady demand and limited supply. President Trump plans to meet President Xi Jinping to discuss trade issues, including soybean exports.

“HAPPILY EVER AFTER” FOR HOLLYWOOD?

Movies often have a “happily ever after,” and Trump wants one for Hollywood. He threatened to slap a 100% tariff on foreign-made films, but how does it even work? Most movies are transmitted virtually and don’t go through ports.

Will the 100% tax apply only to theatre tickets, or will Netflix and other streaming services also have to pay? Could this make subscriptions more expensive?

What makes a movie “U.S.-made”? Is it American if it’s filmed in the U.S. but stars foreign actors, directors, or funding?

Over the last 15 years, Disney has saved $2.2 billion by filming major films and streaming series in the U.K. Also, many Hollywood blockbuster movies are U.K.-made, including The Batman and Jurassic World: Dominion.

Our favorite Deadpool movies were mostly shot in Vancouver, British Columbia, Canada.

So, if the tariffs are imposed, will they actually help or hurt Hollywood?

CBSA SYSTEMS HIT A SNAG!

Commercial crossings slowed this week after CBSA couldn’t send or receive electronic data from Monday night through Wednesday morning. While CBSA hasn’t confirmed, the CARM system is suspected to have caused the outage.

Trucks piled up at major crossings like Peace Bridge and Lewiston-Queenston, with long car queues reported in Buffalo. Importers and brokers also struggled as Statements of Account were delayed. If CARM is to blame, this isn’t new; back in August, missing Statements of Account from CARM caused major headaches for importers.

“ABOUT MINIMAL THINGS” UPDATE

Here’s what’s happening so far since U.S. Customs suspended the de minimis exemption on 8/29, according to CBP:

📦 More Shipments Processed – 3.7 million shipments that used to be duty-free are now being processed

💰 Higher Trade Revenue – $130.5 million in duties collected on these shipments

🌎 Better Compliance – 1.3 million international mail shipments processed, bringing in $11.6 million in duties

SORRY, WE’RE CLOSED FOR NOW!

The U.S. government shut down just after midnight on October 1, 2025, after Congress failed to reach a funding bill. This shutdown impacts many areas, including trade:

About 750,000 federal workers, including many in trade-related jobs, are furloughed.

Customs officers continue working, so ports stay open, but paperwork and inspections may slow.

Agencies like the FDA and THE USDA operate with fewer staff, causing delays in import inspections.

Some regulatory bodies, like the Federal Maritime Commission, have paused work, delaying import approvals.

Supply chains may see backups, extending wait times at ports and warehouses.

U.S. economic growth could shrink by 0.1% to 0.2% per week

Automated Commercial Environment (ACE) support remains available for trade inquiries.

A DAY IN THE LIFE OF A TRADE COMPLIANCE MANAGER

To some, trade compliance is only about managing a long list of meetings, emails, and reports. But each task directly protects importing and exporting businesses from fines, legal issues, and operational hiccups.

In this corporate parable by Braumiller Consulting Group, they feature how Erika, a trade compliance manager, turns a busy day into a big impact on a company’s bottom line and reputation.

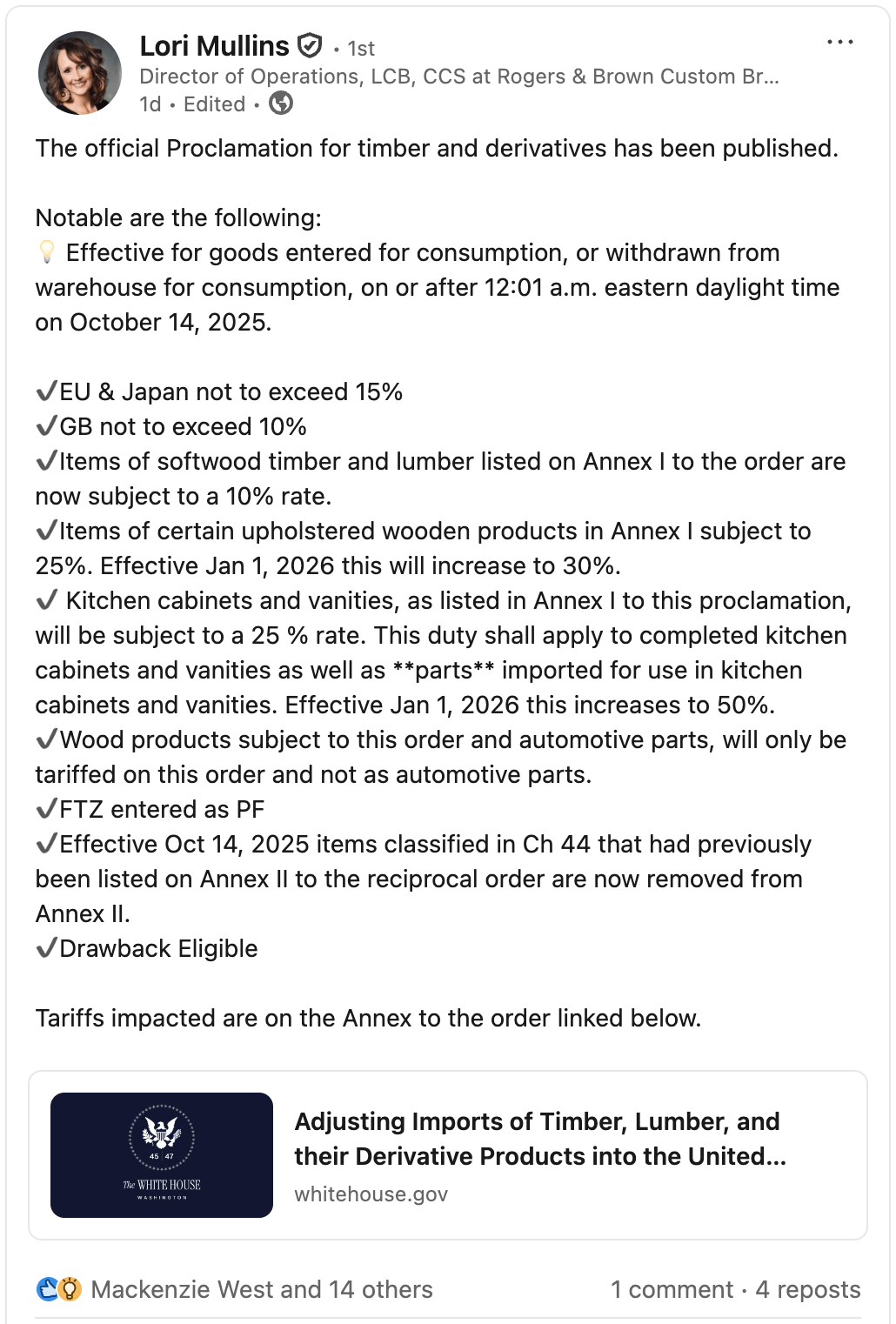

TIMBER TARIFFS: WHAT YOU NEED TO KNOW

In her LinkedIn post, Lori Mullins breaks down the latest timber and wooden products proclamation under Section 232, which could significantly impact Canada, a major U.S. lumber supplier under strict oversight like the Lacey Act.

Lori Mullins is a seasoned trade compliance expert, and she’s sharing insightful updates worth following on LinkedIn.

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!