Brought to you by your Trade Compliance Friends.

Is it possible for tariffs to fully replace income taxes? We don’t think so!

We did some math and a simple analysis below to show why.

In today’s sub-chapter:

📈 59% tariff on all imports is needed to replace U.S. income-tax revenue (based on 2024 data), but is it worth it?

🤔 Costco's lawsuit could create a safe zone for others to seek refunds. Who will file next?

🇪🇺 The EU isn’t ready for a trade war with the U.S.

🌎 Free trade is better, says the world’s richest person

59% TARIFF AS A TAX IS A DISASTER!

No more IRS filings. Bigger paychecks for Americans. What’s not to like, right?

President Trump has, uhm, once again made a bold proposal: replace income taxes with tariffs. He said that revenue from his sweeping tariffs might be enough to replace the federal income tax.

I know a lot of people are cheering and hoping. And I don’t want to rain on anyone’s parade, but here’s the truth: TARIFFS CAN’T REPLACE TAXES.

I’m not an economist, but I don’t need a PhD in basic analysis to figure this out! There’s not enough money. And if ever it gets upheld, the consequences are catastrophic!

You don’t believe me? Well, for starters, here’s a sample math:

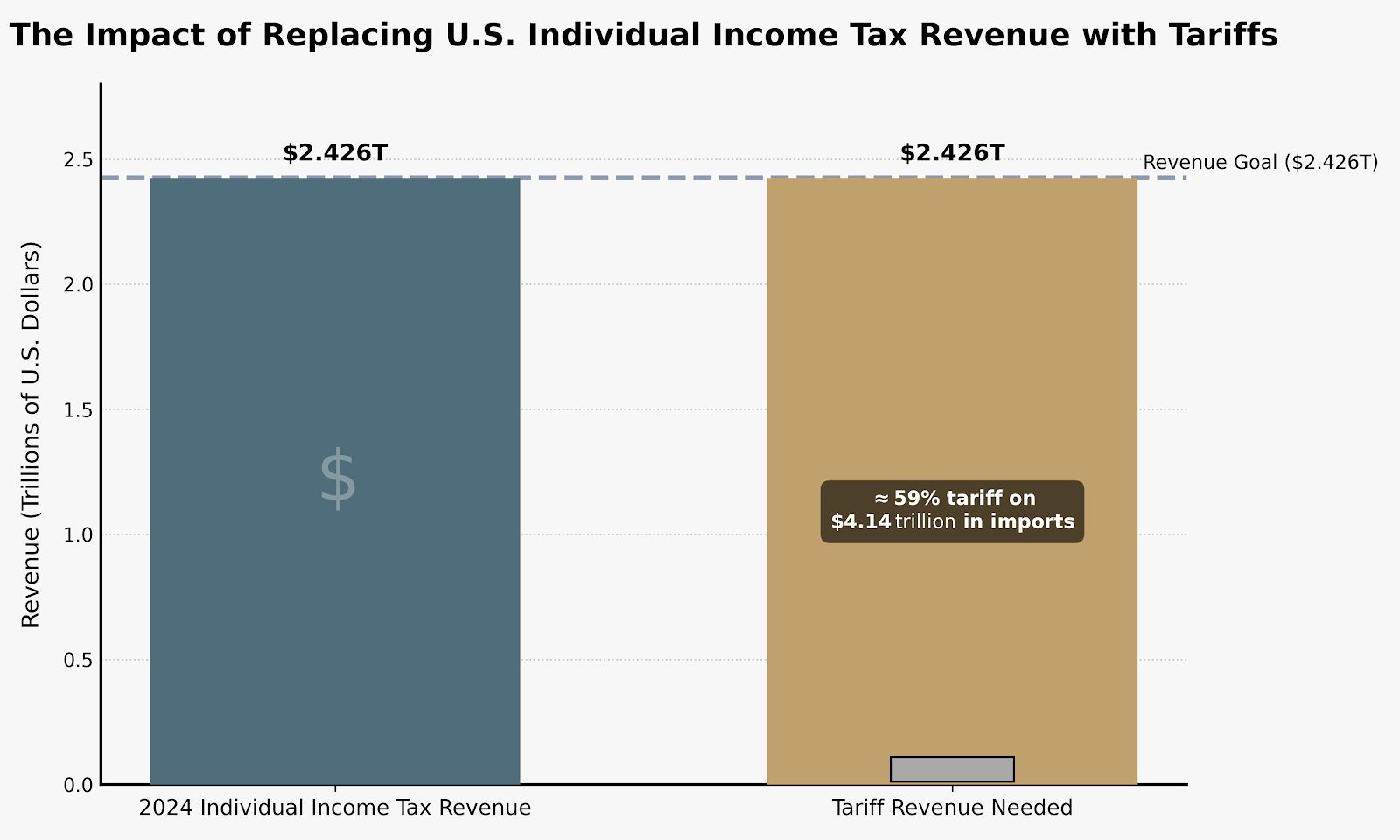

In fiscal year 2024, the U.S. federal government collected about US$2.426 trillion from individual income taxes. And the total U.S. imports of goods and services reached about US$4.14 trillion.

Now, let’s say the goal is to replace all individual‑income‑tax revenue with tariff revenue:

Tariff‑revenue goal: US$2.426 trillion (2024 income‑tax revenue)

Import base: US$4.14 trillion (2024 imports)

Then, the tariff rate needed would be ≈ 2.426T / 4.14T ≈ 58.6%

59% TARIFF.

That’s what the U.S. government needs to impose on all imports to raise as much revenue as income taxes. And this is an exaggerated estimate because it assumes no change in import volume and 100% collection, which I don’t think is going to happen. We know very well that tariffs are inadequate and very unstable. And there’s the legal complexity of imposing them.

To be fair, let's say Trump found a way to make it revenue-neutral. What would be the distributional consequences? I think the government will still try to squeeze the lemon. On the surface, two things may happen:

The tax burden is passed on to the poor and middle class. Taxes would convert to sales taxes, which would hit lower-income households harder.

Public services and benefits would face cuts, which means the poor get squeezed the most.

And let’s not forget, the Supreme Court is yet to rule whether Trump’s IEEPA tariffs (which administration officials insist are not revenue-generating) are even illegal. If SCOTUS rules against these tariffs, where will Trump get the money for all his spending promises? Remember, he has other plans, including a $2,000 tariff dividend check and a generous bailout for farmers. Which one will he prioritize first?

What’s more, lawmakers have to approve this plan, and these people insist they’d rather see the money used to reduce the deficit.

Now, let’s talk about the impact on global trade. As with our math earlier, the U.S. needs a uniform tariff of 59% to be revenue-neutral. If this happens, Trump will be antagonizing U.S. trading partners and might provoke worldwide trade wars. This year, the highest tariff rate we’ve seen so far is 50%, which affected Brazil, India, and Lesotho, and it has already caused major disruption.

How much worse would it be if it jumped to 59%?

It will ignite a chain reaction. Trading partners will look for other markets. Imports would decline sharply. It will disrupt global supply chains and increase the cost of both imported goods and domestic products that rely on parts from other countries.

As appealing and simple as it sounds to say goodbye to income taxes on American paychecks, the consequences would be disastrous: widespread supply chain breakdowns, deep recession, major inflation, job losses, and higher prices.

A taxpocalypse, I would say.

What can global companies do about this? There’s an urgent need to better understand and identify how the risks affect their businesses. They can seek opportunities to engage, such as lobbying to influence ongoing trade policies, whether it’s through submitting comments during rulemaking, requesting specific exemptions, and participating in industry coalitions.

So, uhm, I’ll say it again in caps: TARIFFS CAN’T REPLACE TAXES.

A tax cut? Maybe.

THANKSGIVING HOLIDAY BLUES FOR TRUMP

Costco, one of the largest retailers in the world, is joining other companies that want their money back from Trump’s IEEPA tariffs. In its suit filed over the Thanksgiving holiday, the company is seeking a full refund of all duties it paid under the emergency tariffs.

It’s interesting to see bigger players coming out and joining the fight. Other companies, including Revlon, Bumble Bee, and Berlin Packaging, have also filed similar lawsuits.

Costco argues in the lawsuit that Customs and Border Protection (CBP) denied multiple requests the company made for finalizing tariff payment. And this is critical because IEEPA tariffs are nearing liquidation. Once an entry liquidates, it becomes nearly impossible to get a refund, even if SCOTUS rules against Trump’s tariffs.

But there’s still a lot of uncertainty on the scope and process for refunds if the tariffs are invalidated. For example, no one yet knows how tariff refunds would work and whether SCOTUS may limit refunds to all companies or only to those directly involved in the suit.

But I’d love to think Costco’s lawsuit becomes a tipping point for other affected companies to follow. And since Costco is one of the largest players, it’s worth watching how far they’ll go. If they can’t get a refund, what chance do smaller companies have?

And I wonder who, if anyone, will file a lawsuit next.

P.S. I’m not a Costco member, but I’m considering. If you want to join too, you can sign up here.

QUICK HITS ON GLOBAL TRADE

⚠️ China Alarmed by Malaysia’s and Cambodia‘s Deals With U.S. China raised concerns with Malaysia and Cambodia over trade deals signed with the U.S., which require alignment on export controls, sanctions, investment screening, and defense trade. Beijing is alarmed that these agreements could weaken its influence in Southeast Asia and pull countries closer to Washington.

💊 U.S. Removes Tariffs on U.K. Pharmaceuticals. The U.S. will eliminate Section 232 tariffs on U.K. pharmaceuticals, ingredients, and medical technology. In return, the U.K. will raise prices for new medicines by 25% and reduce VPAG repayments. The agreement strengthens supply chains, encourages investment, and supports jobs in life sciences.

🇹🇼 Taiwan Seeks Lower U.S. Tariffs. Taiwan wants U.S. tariffs on its exports reduced from 20% to 15% and aims to finish talks by year-end. Talks focus on the “Taiwan model” and TSMC, the world’s largest contract chipmaker, which is investing $165 billion to build semiconductor factories in Arizona.

🇰🇷 U.S. Confirms 15% Tariff on South Korean Goods. The U.S. finalized tariff changes on selected South Korean products, including timber, lumber, aircraft, vehicles, and parts. Most adjustments apply retroactively to November 14, 2025, with earlier changes for automobiles and auto parts on November 1.

EU’S FAMOUS TRADE BAZOOKA DIDN’T WORK?

Last July, the EU and U.S. reached a controversial deal at Trump’s Turnberry golf course in Scotland. Under the deal, the EU will pay 15% tariffs on its exports, while slashing its own tariffs on most goods to zero.

European farmers condemned the deal, accusing the EU of giving American agricultural products unfair access while EU exports face high tariffs. Many Europeans even think it’s a “humiliation”.

Now, EU members back the deal, but they are seeking the powers to suspend fully or in part any tariff changes if imports harm the EU industry.

But why didn’t the U.S. activate its famous trade bazooka, the Anti-Coercion Instrument (ACI)? ACI is one of the EU’s defense mechanisms against economic coercion by non-EU countries that negatively impact the EU’s trade and investment interests.

Did the EU have no choice but to concede and accept Trump’s demands under pressure? Looks like it isn’t ready for a trade war with the U.S.

It makes sense. The EU’s economy depends heavily on the U.S. In fact, the U.S. remains the top destination for EU goods exports, with the EU exporting €531.6 billion in goods last year. How about China, which is also one of its biggest trading partners? Well, with China’s export policies getting more and more restrictive, there are no indications of possible expanded market access for the EU.

With all these pressures, the EU likely had little or no choice but to accept Trump’s handshake.

Anyway, let’s hope the EU can boost its trade independence and build a more powerful trade bazooka that’s easier to fire.

PENCIL

Apparently, even the world’s richest man can’t stop Trump’s love for tariffs. In a recent interview with Nikhil Kamath, Elon Musk said that he tried to dissuade Trump from using tariffs but was unsuccessful. The Tesla and SpaceX CEO added that free trade is better and more efficient.

Musk saw how Trump’s tariffs backfired when, earlier this year, the EV maker stopped taking orders for certain car models in China after facing a 125% retaliatory tariff from Beijing.

BTW, during the interview, the famous pencil speech was brought up. ICYMI, in April, Musk reposted a video of libertarian economist Milton Friedman explaining how a simple pencil shows the power of free markets.

The idea is that no single person knows how to make a pencil from start to finish. Its parts come from many places:

Graphite mined in one region

Wood sourced from forests in another

Rubber for the eraser, produced elsewhere

Metal ferrule manufactured in yet another location

Lacquer, glue, machinery, and transport provided by countless workers and companies

Thousands of people worked together to make the pencil. And this shows why free trade is essential.

Let’s look at it in modern global trade.

Companies depend on materials, parts, and labor from dozens of countries. When trade stays open, firms would be able to move goods efficiently, control costs, and keep their production steady. Tariffs only add friction to this system. A single tariff on one component affects every step that follows, from sourcing to assembly to the final price.

I agree with Milton and Musk. Free trade makes the world better.

SURPRISINGLY RESILIENT…BUT FRAGILE

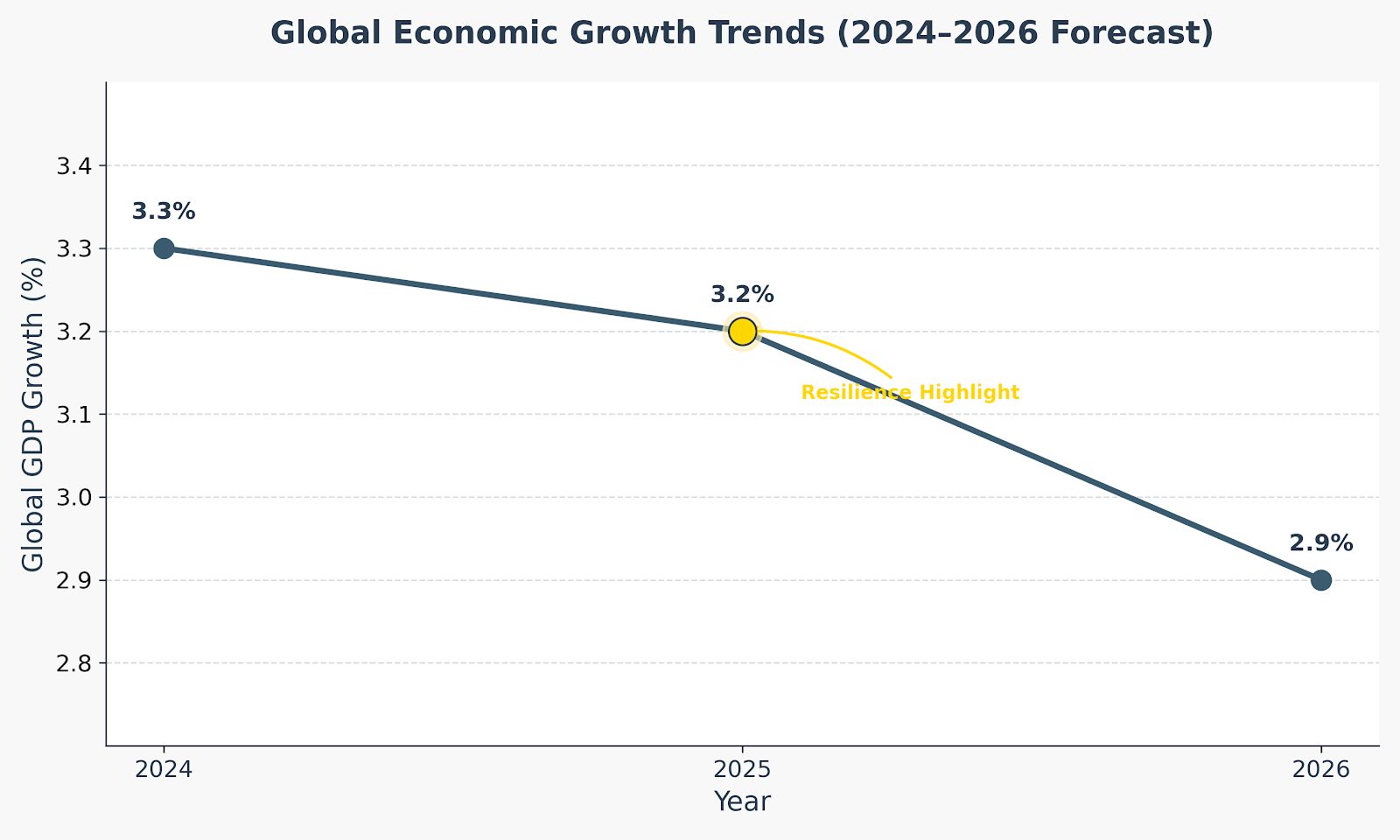

Looks like global growth is holding up better than many experts thought.

The Organisation for Economic Co-operation and Development (OECD)’s latest Economic Outlook shows global growth is slowing just slightly, from 3.3% in 2024 to 3.2% in 2025. We’re seeing surprising resilience despite Trump’s higher tariffs and the constant uncertainty around trade policies.

Thanks to surging investments in AI, sustained fiscal support in some economies, and firms front-loading imports before new tariffs took effect.

Chart generated based on data from OECD’s Economic Outlook

But here’s the twist.

The OECD also warns that the full impact of higher tariffs and trade-policy uncertainty hasn’t fully hit yet, as growth is expected to slow to 2.9% in 2026. And this outlook is fragile, as many factors like ongoing trade tensions, higher tariffs hitting supply chains, and weaker investment sentiment continue to weigh in.

This should be a wake-up call for trading partners to ease frictions and find a lasting resolution to trade tensions. And again, I think this is where a well-functioning free market encourages open, efficient, and fair trade.

For global companies, this is the moment to plan around tariff exposure, diversify sourcing beyond single-country dependencies, and adjust investment timelines to stay ahead of policy and tariff changes in 2026 and beyond.

“MISGUIDED WAY TO RAISE REVENUE”

In his latest episode of This Week’s Economy, Vance Ginn, a seasoned economist and founder of Let People Prosper, explains how tariffs act as hidden taxes on Americans, raising costs for businesses and consumers while creating uncertainty around investment and hiring.

To him, the real solutions lie in restoring Congress’s trade authority, embracing free trade, and reducing government intervention to let people and markets prosper. Follow Vance Ginn on LinkedIn for more insights on trade, policy, and economic strategies.

Source: Vance Ginn (LinkedIn)

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!