Brought to you by your Trade Compliance Friends.

President Trump is considering giving Americans up to $2,000 in rebate checksfunded by tariff revenues. Meanwhile, CBP adopts Altana’s AI-powered Product Passports to make customs faster and trade easier.

In today’s sub-chapter:

💵 $2,000 tariff rebate checks for Americans

🤝 CBP partners with Altana to accelerate customs clearance

🚛 Trump to impose a new 25% tariff on all medium and heavy-duty trucks

🪵 A Canadian cabinet manufacturer is struggling as new tariffs push lumber duties above 45% and add a 25% tax on cabinets

ARE AMERICANS GOING TO GET STIMULUS CHECKS?

Imagine opening your mailbox to find a $2,000 government check.

President Donald Trump is thinking of sending Americans a “tariff dividend” of up to $2,000, funded by revenue from tariffs. In a recent interview with One America News, Trump said the funds would first go toward reducing the federal debt, then possibly be distributed directly to citizens.

Tariffs imposed earlier this year have generated significant revenue. Treasury data shows $214.9 billion collected in 2025, with the White House reporting $158 billion between January and August.

But the $2,000 payout needs Congress’ approval and a clear plan for who qualifies and when. Earlier this year, Senator Josh Hawley proposed a similar plan, the “American Worker Rebate Act,” suggesting at least $600 per adult and child. We haven’t even seen a shadow of the $600 check, so this will make the $2,000 proposal even more of a long shot.

On top of that, the Supreme Court will decide the fate of Trump’s IEEPA tariffs this November. Experts estimate an 80% chance the court will rule them illegal. If the Supreme Court strikes down the tariffs, the government might have to give billions back to importers. That means any rebate checks could come from money the government never really kept.

Economists see a problem: tariffs are meant to raise money and shape trade, but rebates give some of that money back to taxpayers. So, are tariffs really helping the economy, or just making people pay more only to get some back later?

And if the $2,000 rebate hits our mailbox, is it a real relief, or just a way to make the tariffs palatable?

QUICK HITS ON GLOBAL TRADE

🚚Trump Imposing New 25% Large Truck tariff Starting Nov. 1. President Trump announced a 25% tariff on imported medium- and heavy-duty trucks, set to take effect Nov. 1, citing national security under Section 232. However, with Congress on recess due to the government shutdown, it’s unclear whether the tariff has been formally drafted, and even if preliminary work has started, implementing a new 232 tariff will be difficult without lawmakers in session.

🚢 New Section 301 Chinese Vessel Fees Effective Oct. 14. CBP will charge fees on certain Chinese-owned, operated, or built vessels and foreign-built vehicle carriers starting Oct. 14, 2025. Fees vary: Annex I – $50/net ton, Annex II – $18/net ton or $120/container, Annex III – $14/net ton. Operators must pay via Pay.gov before arrival; late payment can block port operations. LNG tankers are exempt.

🤝 Indonesia and Canada Sign Landmark Trade Agreement. Indonesia and Canada signed the Comprehensive Economic Partnership Agreement (CEPA) on Sept. 24, 2025, in Ottawa. Canada will eliminate tariffs on over 90% of Indonesian goods, including textiles and footwear, while Indonesia will cut tariffs on 85.54% of Canada’s priority exports, like wheat and seafood.

🩺🤖 U.S. Investigates Medical and Robotic Imports. The U.S. launched Section 232 investigations on Sept. 2 into imports of medical equipment, robotics, and industrial machinery to assess national security risks. With no reliance on IEEPA or reciprocal measures, the path for tariffs is clear. Following earlier tariffs on steel, copper, aluminum, furniture, trucks, and pharmaceuticals, these investigations signal robotics and medical imports could be next.

PRODUCT PASSPORTS ARE CHANGING TRADE

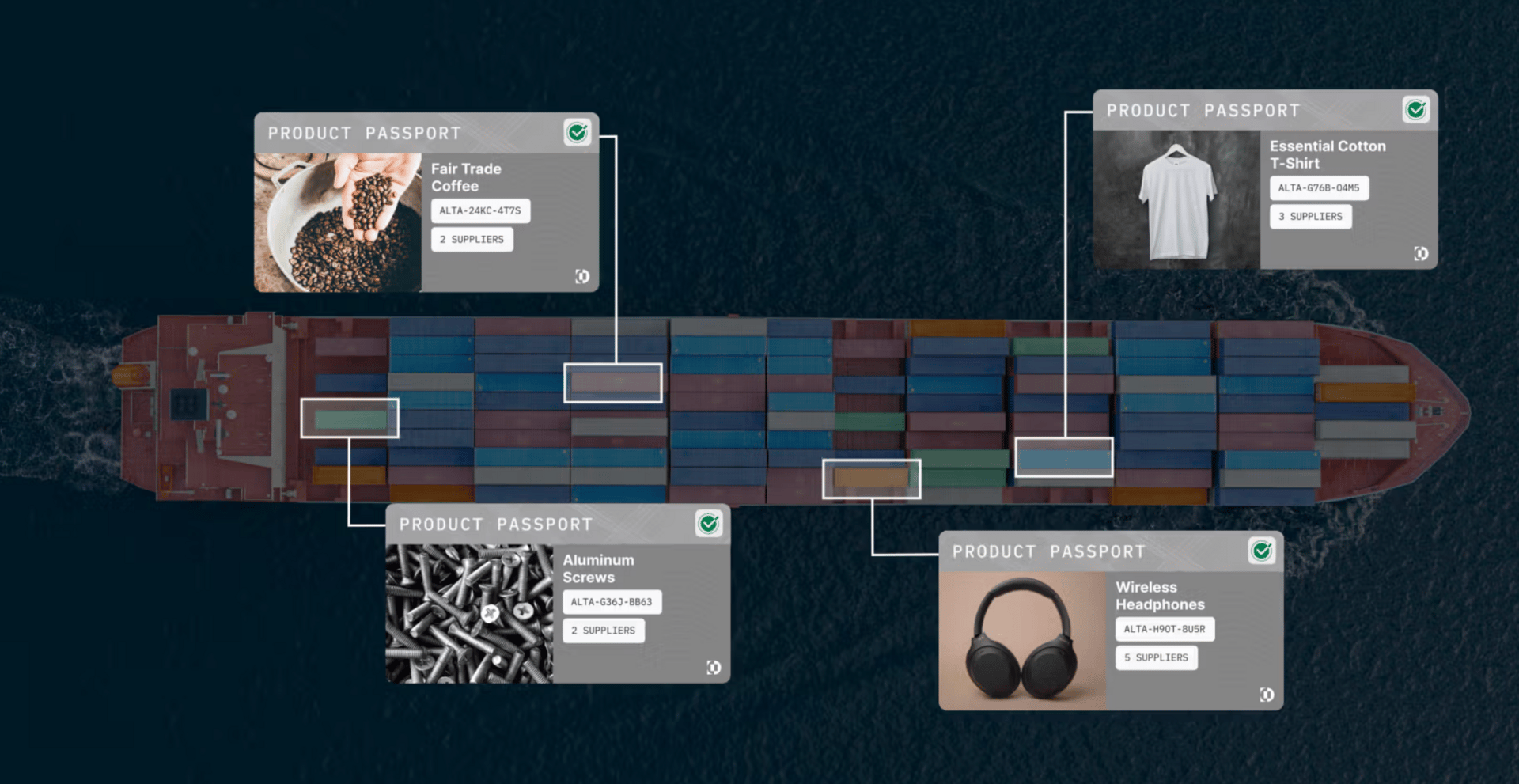

In partnership with the Global Business Identifier (GBI) pilot, the U.S. Customs and Border Protection (CBP) has teamed up with Altana to roll out AI-powered Product Passports that are transforming trade compliance.

Source: Altana

These digital passports provide a trusted, real-time record of a product’s origin, materials, and journey, cutting through the usual paperwork chaos. For importers, this means faster customs clearance, fewer detentions, and less firefighting.

There’s no room for error in compliance, so we’re confident that the advanced AI behind these passports will deliver accurate and reliable information without any chance of hallucination.

Ready to see AI-powered Product Passports in action? Book a demo!

“WE’RE HURTING ALREADY.”

In a news report by the CBC News: The National, Glennwood Kitchen, a cabinet manufacturer in Shediac, New Brunswick, Canada, is scrambling to figure out how to keep its U.S. sales amid the sudden tariff increase.

According to the report, Glennwood Kitchen exports roughly 20% of its products to the U.S. The business can absorb the added costs temporarily, but it’s not a long-term solution. They’ve been racing to develop a plan to recoup the lost revenue.

Someone from the family-run business said, “We're hurting already, and it's going to hurt even faster”.

Last week, President Trump announced new U.S. tariffs on Canadian lumber under Section 232, effective Oct. 14, raising duties on imports to over 45% and adding a 25% levy on wood-based home products.

The U.S.-Canada lumber dispute isn’t new. It began in 1982, when the U.S. claimed Canada unfairly subsidized softwood from public lands. Tariffs and trade agreements have come and gone, but the decades-long conflict continues. Today, Canadian lumber already carries over a 45% U.S. tariff.

“WALK AWAY VERY HAPPY”

Last Tuesday, Canadian Prime Minister Mark Carney met President Trump at the White House to discuss tariffs on steel, aluminum, cars, and lumber. While Trump praised Carney as a "world-class leader," the Canadian prime minister departed Washington without a deal.

However, the meeting left some hopes, as Trump said, “I think they’re going to walk away very happy,” keeping the door open for USMCA talks and possible tariff relief.

Well, we hope to hear some good news soon.

HEADS UP ON TRADE AND TARIFFS!

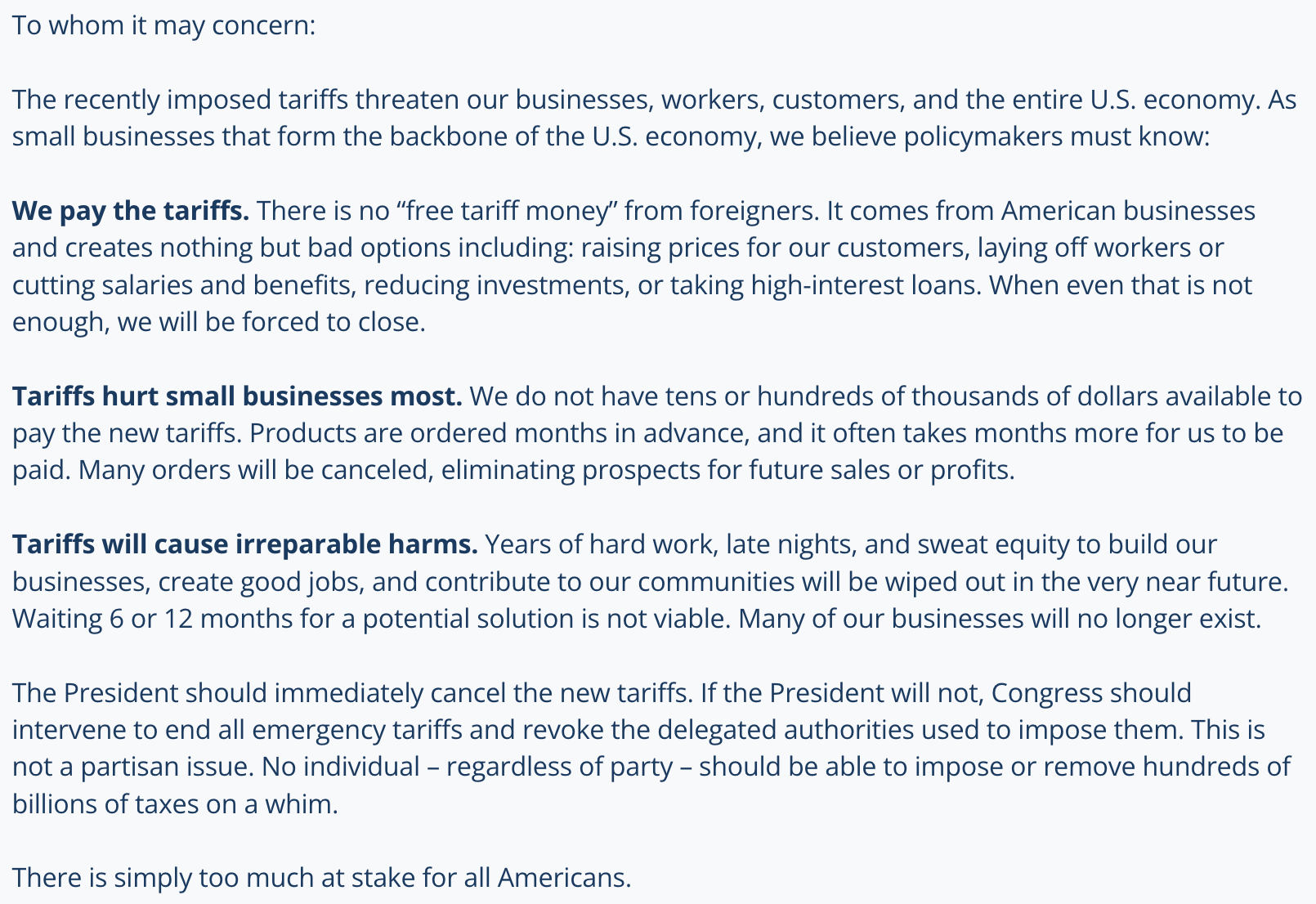

WE PAY THE TARIFFS

Tariffs are raising costs and risking jobs for many. Your voice can help lawmakers understand the real impact. If you want to join the effort, sign the petition letter at wepaythetariffs.com/sign-the-letter.

P.S. We are sharing this for info only; we’re not for or against it.

Source: wepaythetariffs.com

MOONCAKE MYSTERY

Every once in a while, we come across a like-minded trade professional on LinkedIn who’s a must-follow. Meet Jenna Allen. Her Tuesday Trade Trivia is packed with the kind of trade obscurities that make us excited to get out of bed.

Source: Jenna Allen (LinkedIn)

DON’T HAVE YOUR HALLOWEEN COSTUME YET?

Here’s one for those who find the tariff season truly “tarrifying”. Order yours!

Source: r/pics (Reddit)

Ryan Bennett found this gem at Spirit Halloween. COO India (50% tariff) has us dying. What is that irony? 👇

Source: Ryan Bennett (LinkedIn)

“BE PART OF SOMETHING BIGGER”

“With a career at The Home Depot, you can be yourself and also be part of something bigger.”

The company is expanding its Global Trade Team and seeking professionals who are passionate about international trade compliance and operations.

Sr. Analyst, Global Trade Compliance

Apply hereSr. Analyst, Global Trade Operations

Apply here

NO WALL, NO PROBLEM😂

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!