Brought to you by your Trade Compliance Friends.

Canada’s 25% steel derivative goods surtax exempts imports like casual goods, automotive, aerospace, and energy inputs, but non-exempt businesses struggle for fairness under high costs and complex rules.

How can smaller importers compete under these loopholes?

⚖️ Consumer avoids surtax on steel chair; retailer pays 25%.

🤔 Trump questions CUSMA’s value, yet Canadian and Mexican exports remain vital to U.S.

🖥️ CBP hosts quarterly TRLED webinars on trade violations in 2026.

💸 CBP transitions to electronic system; could make potential tariff refunds easier.

LEVELING THE PLAYING FIELD? NOT QUITE!

Canada’s 25% Steel Derivative Surtax Order is Ottawa’s latest move to level the playing field for domestic steel producers.

The government says it’s to reduce reliance on foreign steel.

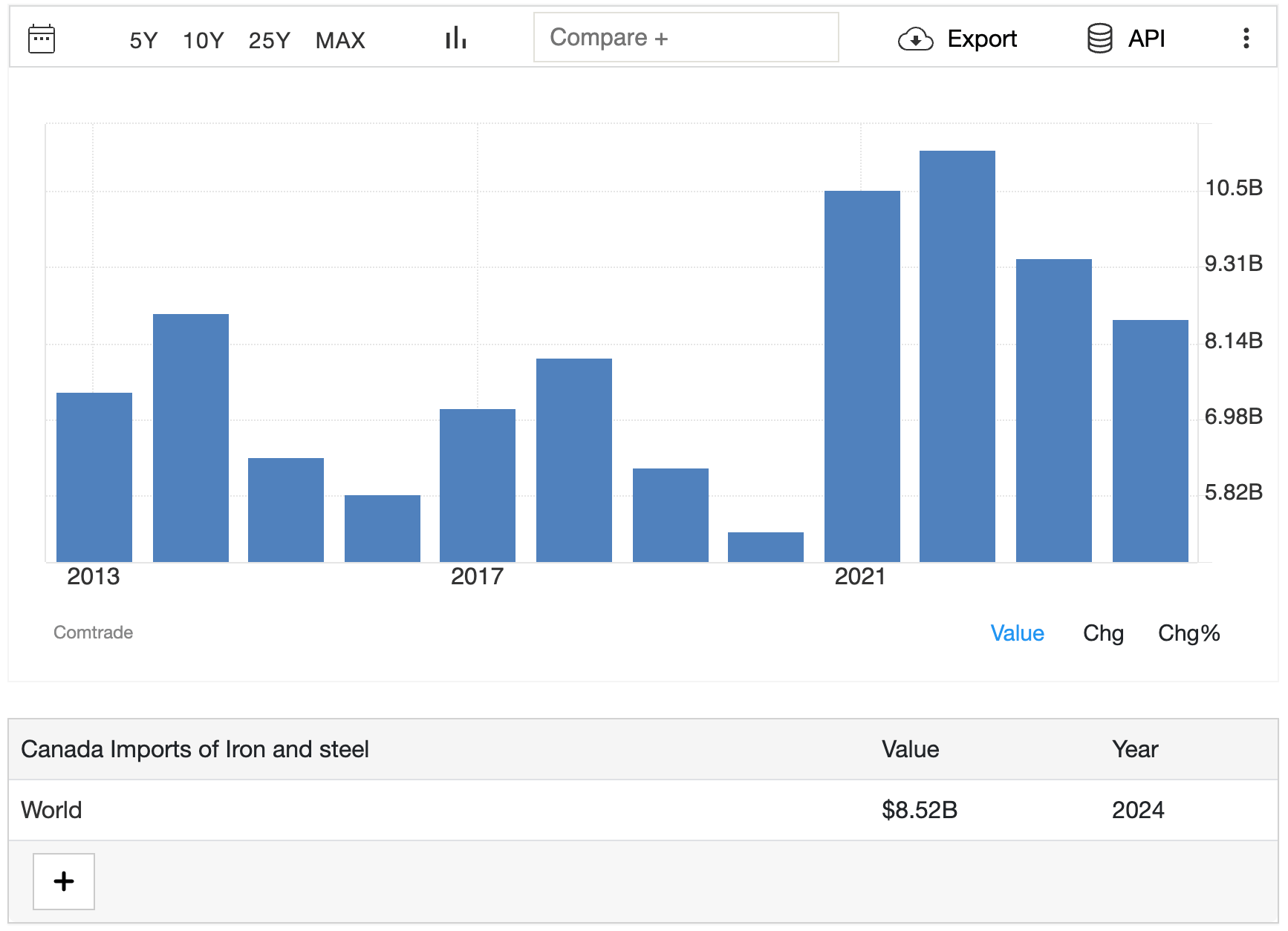

Which makes sense. In 2024, Canada imported about $8.52 billion worth of iron and steel products, which shows that the country greatly depends on foreign suppliers to meet its domestic demand.

Source: Trading Economics

But here’s the problem. Ironically, Canadian businesses feel it’s creating a level-playing-field problem. The culprit? The loopholes, or exceptions, as the order calls them.

So, which goods are exempt from the 25% surtax?

Goods in transit: Shipments already on their way to Canada when the surtax took effect

Casual goods: Items imported by consumers for personal use, not for resale or commercial purposes

Previously taxed goods: Products already subject to another steel surtax (e.g., China Surtax Order 2024, U.S. Steel and Aluminum Surtax 2025)

Chapter 98 goods: Items under Chapter 98 of Canada’s Customs Tariff, including certain repairs, warranty returns, and special imports.

Automotive inputs: Steel derivatives for manufacturing motor vehicles, chassis, or related parts, imported before July 1, 2026.

Aerospace inputs: Steel derivatives for aircraft, spacecraft, or related components, imported before July 1, 2026.

Energy projects: Wind towers and sections under tariff item 7308.20.00 for installation in eligible energy projects west of the Ontario–Manitoba border.

Here’s the problem businesses see:

A consumer can cross the border and bring home a steel-reinforced outdoor chair. No surtax because it’s a casual good. Meanwhile, a Canadian retailer imports the same chair to sell in their Toronto store. 25% surtax applies.

Sounds unfair? It is.

Businesses across non-exempt sectors are frustrated because they can’t compete with consumers who bypass the surtax, and it makes local prices higher.

And while the special treatment for some industries makes sense, retailers and general manufacturers are left paying the surtax. To me, it looks like giving VIP treatment to large industries, while smaller businesses are left to scramble. It’s practical from a macroeconomic perspective, but frustrating on the ground for retailers and manufacturers who aren’t considered “essential” sectors.

Just to be fair, these non-exempt businesses aren’t complaining that essential sectors are getting exemptions.

They just want clarity. Definitions like “Casual Goods” are vague, and companies need concrete guidance on what products fall under exemptions. Because ambiguity hurts planning, pricing, and competitiveness.

They want fairness. Applying the surtax to the full product value rather than just the steel component feels punitive. U.S. tariffs target only the steel portion; why should Canadian businesses be treated differently?

They want speed and responsiveness. Thousands of individual remission applications have yet to be assessed, with businesses still waiting for decisions while costs accumulate. Companies are asking for a better process that actually works.

They want a voice. Companies want their examples, their impact stories, and the real challenges communicated to policymakers. Affordability for Canadians. Competitiveness of Canadian retailers. Protection of local jobs. They’re looking for the government to listen and adjust, not just enforce blanket measures.

And why do these companies care?

A 25% surtax on imported steel derivatives can seriously hurt a business’s bottom line. Imagine a fictional mid‑size furniture company, Maple Home Furnishings, which imports steel‑framed chairs and tables from overseas. Their typical profit margin is around 8–10%, fairly standard for retail furniture. Suddenly, that 25% surtax hits their shipment of $100,000 worth of steel goods. That’s $25,000 extra in costs, more than double their expected profit on the order. So, to avoid losses, Maple Home would either have to raise prices, absorb the cost, or find another supplier, likely at a higher cost.

And it can be a challenge for many Canadian importers.

According to Canada’s Department of Finance, steel derivative imports subject to surtaxes reached $10.6 billion in 2024, meaning the total potential impact of the surtax could be more than $2.6 billion across affected industries.

Remissions As a Workaround

Canadian businesses could have a “get-out-of-jail-free” card through remissions. But here’s the catch. It’s SLOW and COMPLICATED.

Companies need to show lots of proof, such as shipping documents, exact product classifications, and what the steel will be used for. And it’s frustrating for businesses because they have to do all this extra work, which consumers can get for free.

So, again, the main issue is fairness. The rules are overly complicated, slow, and don’t reflect reality on the ground. Especially for non-exempt sectors.

Because of this, companies now have to plan every step carefully:

Timing shipments: Businesses must schedule shipments strategically to take advantage of these timing exemptions.

Classifying products precisely: Customs rules are strict. Steel can appear in hundreds of product types: from door frames to furniture reinforcements. One misclassification could trigger the 25% surtax. Which is why many importers rely on customs brokers to ensure accurate codes and avoid the 25% surtax.

Proving usage: Document the intended use of the goods, whether for an exempt sector like automotive or aerospace, to qualify for relief.

When all is said and done, let’s hope non-exempt businesses get the clarity and support they need, and that Ottawa can find a more practical and sustainable way to “level the playing field.”

IRRELEVANT?

6 years ago, Trump called CUSMA the most important trade deal ever made by the U.S.

2 days ago, during his visit to a Ford factory in Michigan, he said the deal is “irrelevant” and that the U.S. doesn’t need cars from Canada or Mexico.

“The problem is we don’t need their product. We don’t need cars made in Canada, we don’t need cars made in Mexico, we want to make them here,” he told reporters.

Which is surprising, given the numbers.

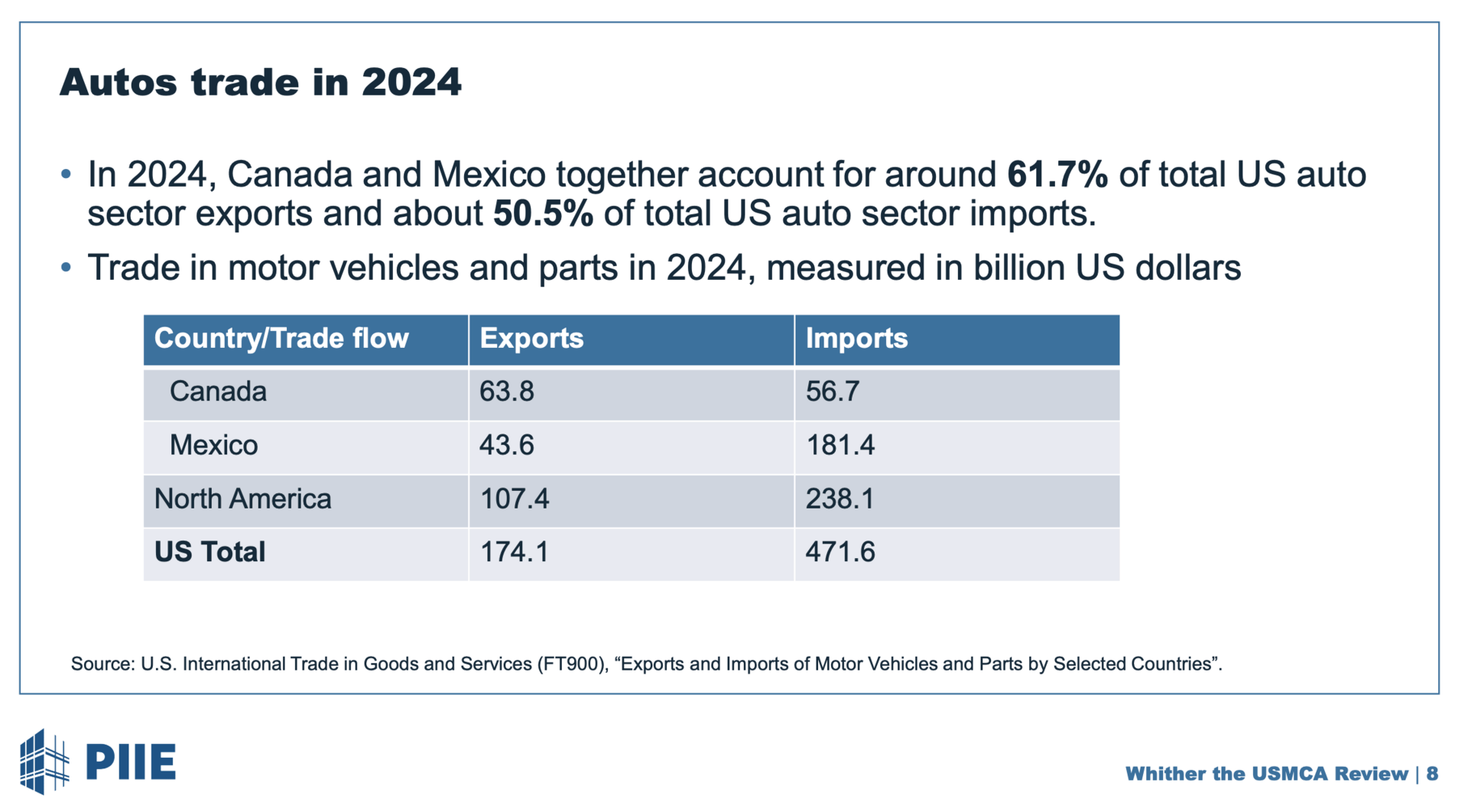

In 2024, U.S. imports of motor vehicles and parts from Canada totaled about $56.7 billion, while imports from Mexico were much higher at roughly $181.4 billion. Together, the two countries accounted for about half of all U.S. auto imports that year. That means Canadian and Mexican cars and parts are still essential for the U.S. automotive industry.

Source: Peterson Institute for International Economics (Presented at Dallas Fed-PIIE Conference)

If Washington walks away from CUSMA, it could hurt not only Canada and Mexico but also U.S. trade flows and hit jobs in key automotive hubs such as Michigan, Ohio, and Detroit. Workers and businesses could lose access to key markets or face retaliatory tariffs.

How will Canada and Mexico hold up if the U.S. exits CUSMA?

Ottawa is working on its diversification strategy and is also looking to strengthen its EV industry and supply chain, especially given the global oversupply of EVs from China. It’s also negotiating a free trade deal with the UAE and preparing for the UK’s accession to the Comprehensive and Progressive Agreement for Trans‑Pacific Partnership (CPTPP).

Mexico and Canada are strengthening bilateral ties through a new Canada‑Mexico Action Plan (2025–2028), though Mexico has ruled out a separate bilateral free trade agreement with Canada because of the CUSMA framework. Meaning, if CUSMA completely shuts down, both countries still have a framework in place to keep trade going.

Hopefully, these moves could help cushion both countries if CUSMA becomes less predictable. At the very least, they could allow Canadian and Mexican businesses to tap demand outside the U.S., especially in key sectors like automotive, clean technology, agriculture, and critical minerals.

NOT PUTTING ALL THE EGS IN ONE BASKET

As Canada is trying to level the playing field for its industries and stop relying so much on the U.S., the government is pushing harder to diversify trade. And China is a big part of that plan.

This week, Prime Minister Carney is in Beijing for the first official visit by a Canadian leader in nearly a decade, meeting with President Xi as Canada looks to expand trade beyond the U.S.

But how far can this strategy go? Can diversification meaningfully reduce Canada’s reliance on its largest trading partner?

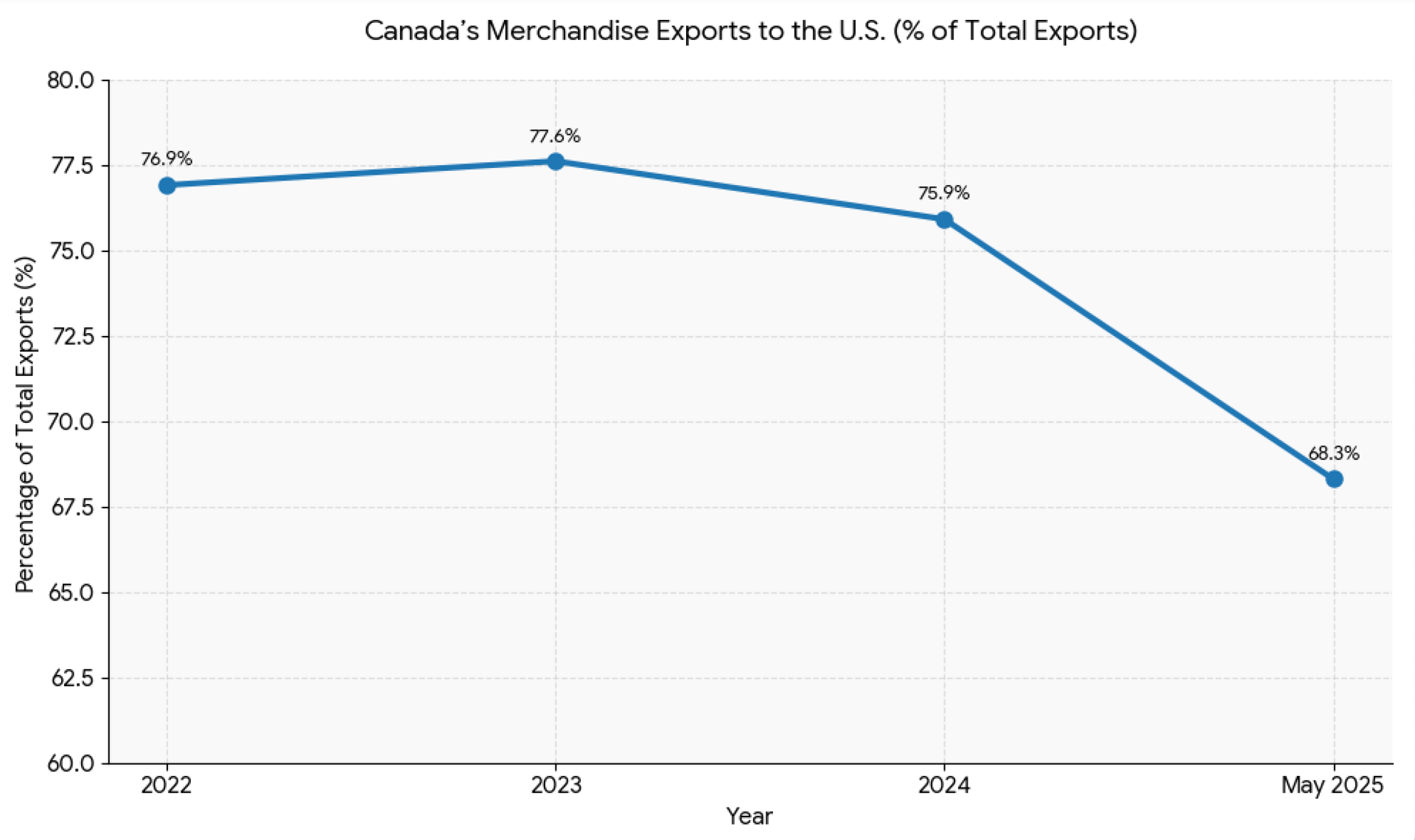

Let’s look at the numbers over the past few years. In 2022, the U.S. accounted for 76.9% of Canada’s merchandise exports, rising to 77.6% in 2023. In 2024, Canada still sent about 75.9% of its domestic exports to the U.S. By May last year, that share had fallen to roughly 68.3% of goods exports, marking the largest monthly decline in recent years.

Looking at this pattern, diversification away from the U.S. is gaining some traction, but the shift remains modest.

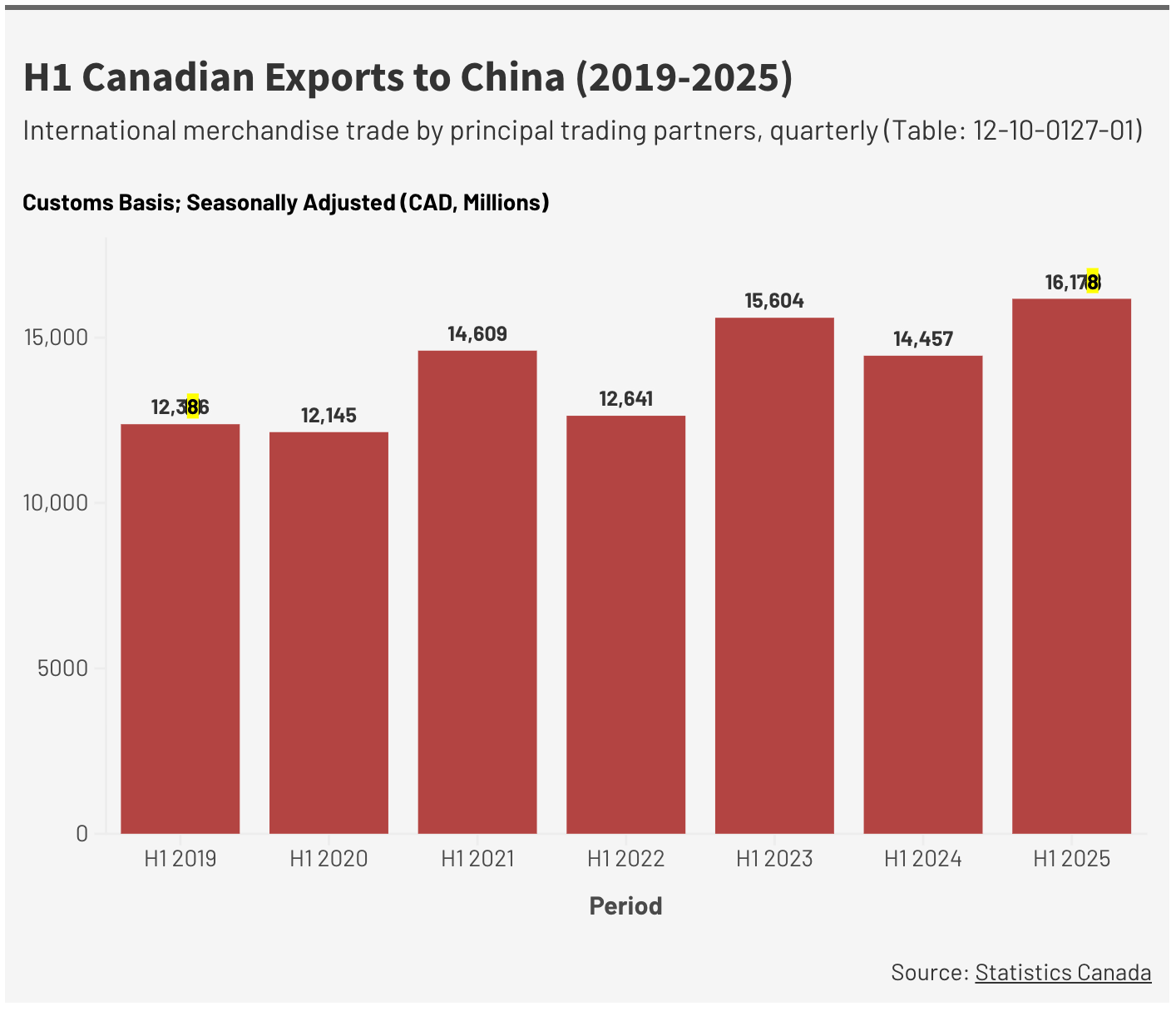

Can Canada really count on China and other markets to offset U.S. dependence? In 2024, exports to China accounted for 3.8% of Canada’s total merchandise exports. And in the first half of 2025, China represented only 4% of Canada’s total exports.

Based on the chart below, we see growth in exports to Beijing, but it’s relatively limited.

Source: Canada China Business Council

In fact, even when China is combined with the EU (which represented around 8% of Canada’s goods trade in 2023) the total is still dwarfed by the U.S. Yes, these numbers don’t necessarily dictate Ottawa’s future trade path with these trade partners, but they give us an idea of how difficult it wil be for Canada to offset its dependence on the U.S.?

Which leads me to my main point.

Ottawa’s diversification strategy isn’t about abandoning or replacing the U.S at all. It’s about supplementing it. Canada will pursue China, the EU, and other emerging markets, which makes sense in today’s volatile global economy, where tariffs, trade wars, and policy shifts are disrupting business plans.

And let’s hope Ottawa can successfully expand its trade without exposing Canadian businesses to new risks.

QUICK HITS ON GLOBAL TRADE

💻 Trump Imposes 25% Tariff on Semiconductors Under Section 232. Starting January 15, 2026, the U.S. imposes a 25% Section 232 tariff on certain advanced semiconductors, including NVIDIA H200 and AMD MI325X. The tariff applies to imports not supporting the U.S. technology supply chain, with exemptions for data centers, R&D, startups, consumer, industrial, and public sector uses.

💵 U.S. Has Enough Money for Tariff Refunds, Bessent Says. Treasury Secretary Scott Bessent says the U.S. has nearly $774 billion in cash to cover potential Trump-era tariff refunds, which would spread over several weeks or up to a year. He doubts SCOTUS will strike down the tariffs, calls refunds a “corporate boondoggle,” and says tariffs haven’t caused inflation.

🇮🇳 Deal with India Stalled Because PM Modi Didn’t Call Trump. India denied this, saying the two sides held several talks and spoke eight times over the phone last year. Major issues, especially agriculture, are still unresolved, and there’s no clear timeline for a deal yet. Trump imposed 50% tariffs on Indian goods, including penalties for Russian oil purchases, but India’s exports to the U.S. have continued to grow despite the tariffs.

🇮🇷 Trump Plans 25% Tariff on Countries Trading with Iran. President Trump said he will impose a 25% tariff on any country doing business with Iran. Key trading partners include China, Turkiye, India, and Pakistan, with China buying 80% of Iran’s oil. U.S. sanctions have reduced Iran’s oil exports, trade revenue, and GDP per person.

CBP ISN’T TAKING A BREAK, AND NEITHER SHOULD YOUR COMPLIANCE GAME!

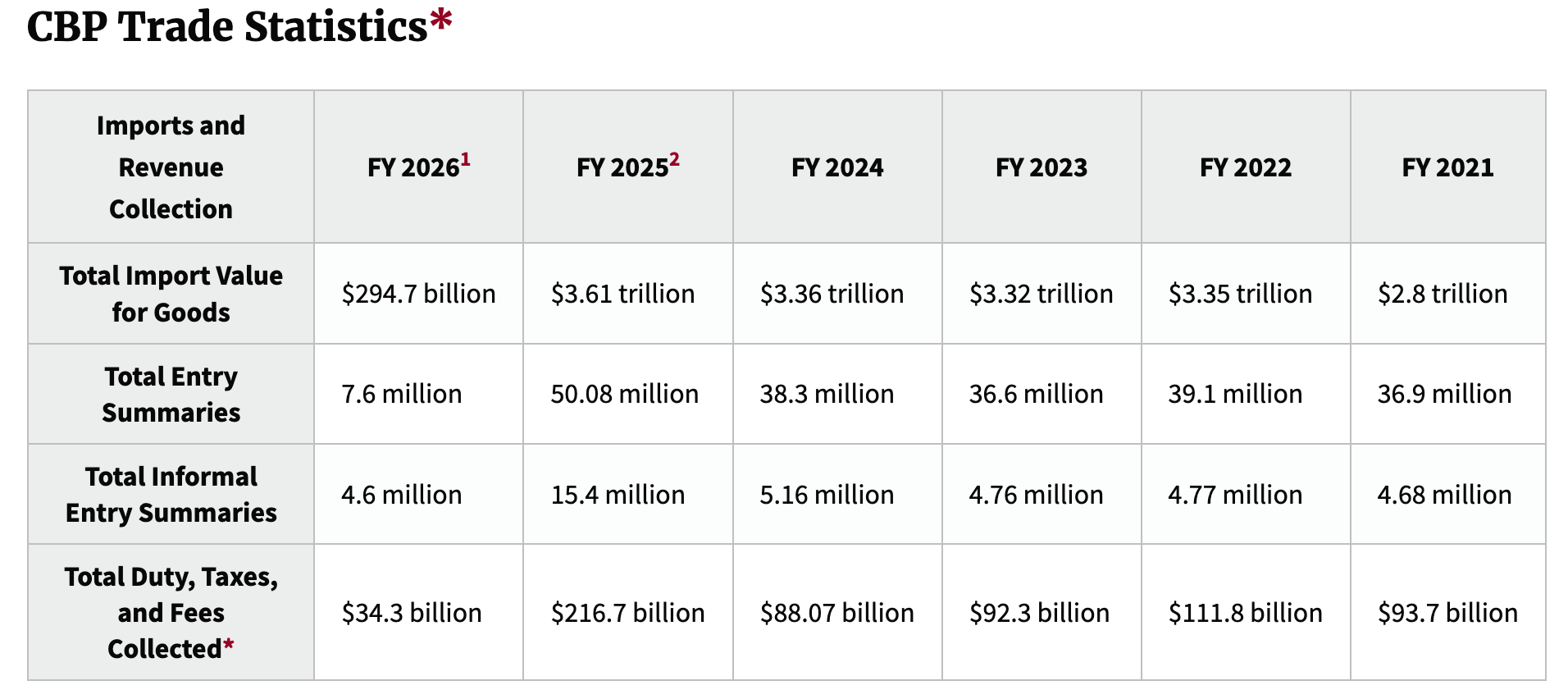

CBP isn’t messing around when it comes to trade compliance. Here’s the FY 2025 story:

CBP uncovered more than $400 million in unpaid duties through EAPA investigations from Jan–Aug. In that same period, CBP identified 89 cases with reasonable suspicion of duty evasion.

Total trade penalties issued by CBP exceeded 2,200 cases in FY 2025, showing active enforcement.

CBP recorded nearly 47,000 liquidated damages cases tied to violations.

Trade penalties and damages collected in FY 2025 totaled roughly $37.9 million.

CBP completed 348 audits in FY 2025 to verify compliance with trade laws.

Audits recovered nearly $192.8 million in duty revenue from importers in FY 2025.

Source: CBP

You don’t want your business popping up in the stats, do you? Time to level up your compliance game. CBP is hosting its 2026 quarterly TRLED webinars to help importers and trade pros stay sharp. Q1 covered the Trade Violations Reporting (TVR) tool (Jan 13), and the next session on the Enforce and Protect Act (EAPA) process is today, Thursday, Jan. 15 at 1:30 p.m. EST.

We’ll give you a heads-up as soon as CBP releases the full 2026 TRLED schedule.

Register here to attend: https://go.dhs.gov/4i4

IS CBP PREPARED? JUST IN CASE COURT SAYS NO!

Trump said last Tuesday that tariff refunds would be a complete mess and that it’s almost impossible for the country to pay.

But importers are quietly hopeful, especially with the new electronic refund system.

Starting February 6, the agency will move all tariff refunds to electronic distribution through the ACE portal, following the Electronic Refunds Interim Final Rule (IRF). No more paper checks.

Is this a sign that the Trump administration is ready for possible refunds if the SCOTUS rules against Trump’s IEEPA tariffs?

As of today, there’s no confirmed tariff refund process yet, but the shift to electronic refunds somehow gives importers hope that any potential reimbursements, if they happen, will be much faster and smoother.

That’s why, for importers, don’t forget to:

Confirm ACE access. Make sure your company has an active ACE Portal account with the Importer sub-account view.

Identify the Trade Account Owner (TAO). Only the TAO can manage refund banking information in ACE.

Complete ACH enrollment. You should have your U.S. bank information on file in ACE.

Review CBP Form 4811 setups. Confirm who receives refunds on your behalf and ensure those parties are properly aligned.

Plan ahead. These updates are a preparatory step. CBP has not moved to electronic-only refunds yet, but this setup positions importers to receive refunds once that transition happens.

CHINA’S MOST AMBITIOUS PROJECT

If you care about global trade, you should follow Nicolas Urien. And his Substack is where you want to be.

His latest post dives into Hainan, a Chinese island being built into a regional trade hub 50X bigger than Singapore. It’s not just a free trade zone; it’s a gateway, a platform, and a manufacturing base all in one.

Nicolas explains how China plays the long game: building infrastructure, connecting markets, and turning strategy into action. This could change China–ASEAN trade and even shift Singapore’s role in the region.

Source: Nicolas Urien (LinkedIn)

BREW YOUR NEXT CAREER IN TRADE

If coffee runs through your veins and global trade runs through your brain, this is for you! Starbucks is looking for a Senior Manager, Global Trade, to lead the company’s compliance strategy.

Location: Seattle, WA | Salary: $146K–$244K | In-Office 4 Days/Week

Requirements: 10+ years in customs/trade, leadership experience, strategic mindset, US Customs Broker license a plus.

Perks: Comprehensive benefits, 401(k) match, Bean Stock, tuition coverage, paid vacation, and more.

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!