Brought to you by your Trade Compliance Friends.

Lawmakers introduced a new bill to replace the First Sale Rule with Last Sale Valuation. How will it impact companies with multi-tier supply chains?

In today’s sub-chapter:

💰The Last Sale Valuation Act

🇺🇸Americans paid nearly 90% of Trump's tariffs in 2025: New York Fed

📦The Secure Revenue Clearance Channel Act

🛡️Trade compliance is no longer a “nice-to-have”

FIRST SALE OUT! LAST SALE IN??

With recent tariff changes and the end of de minimis exemptions, the First Sale Rule (FSR) has become a highly effective method for reducing import values and tariffs.

Major global brands, including L’Oréal, Moncler, Ferragamo, and Kuros Biosciences, use FSR in their tariff planning strategy.

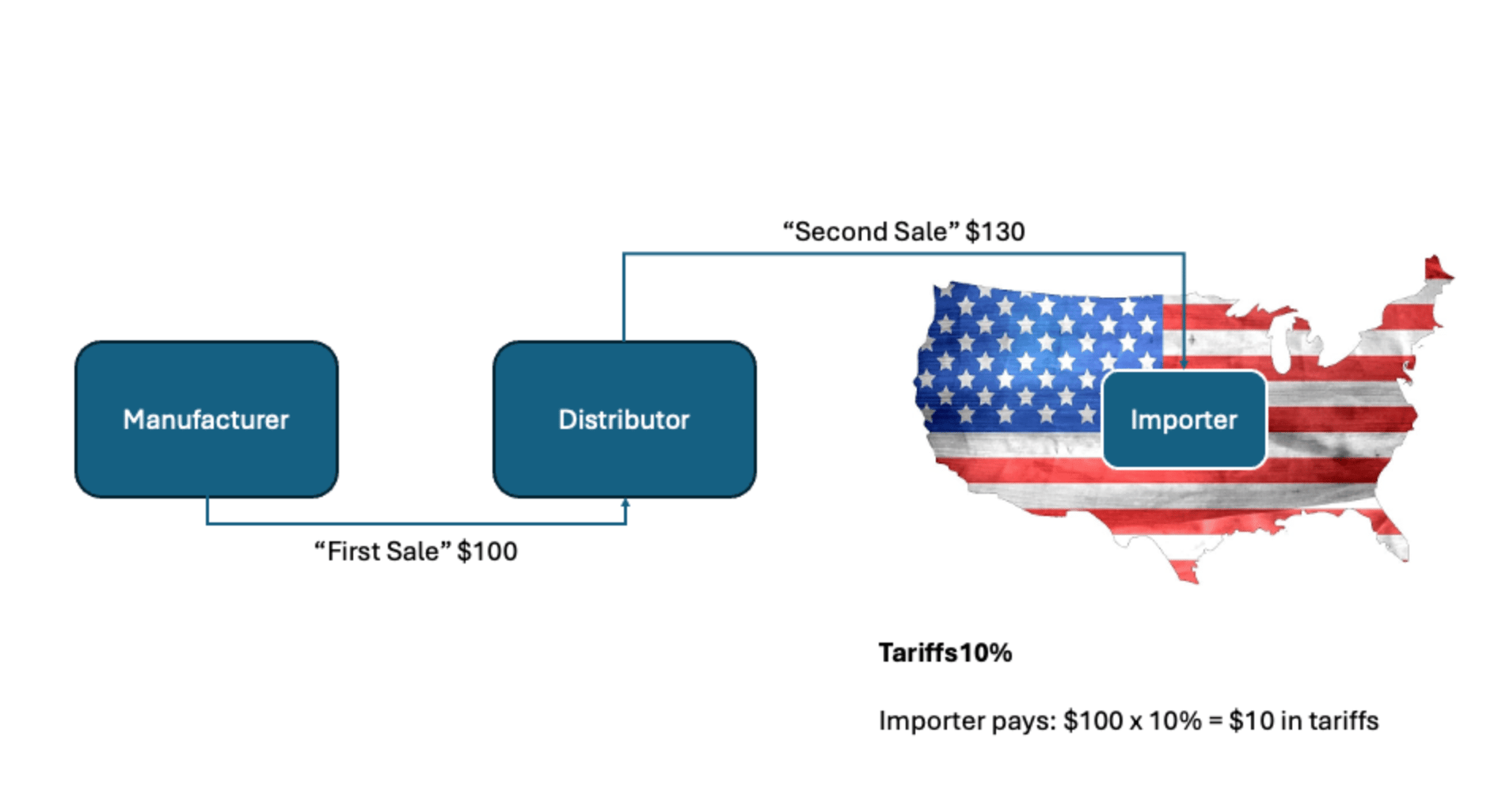

Under this rule, U.S. importers can calculate customs duties based on the price paid in the first sale of goods for export to the U.S., rather than the inflated price charged by a middleman.

For example, a manufacturer in India sells machinery parts to a European distributor for $100,000, who then sells them to a U.S. importer for $150,000. With FSRe, the importer pays duties on $100,000 instead of $150,000.

Obviously, this rule is highly effective as the price paid is often less on the first sale. Which means FEWER TARIFFS.

In his LinkedIn article on Customs Valuation and the First Sale Rule, Erik van der Hoeven, a compliance and fintech advisor, shares a simple diagram of how using FSR can lower tariffs.

Source: Erik van der Hoeven (LinkedIn)

But That May Change

On February 11, 2026, Senators Bill Cassidy (R-LA) and Sheldon Whitehouse (D-RI) introduced the Last Sale Valuation Act of 2026, which would require importers to use the last sale price instead.

Proponents and supporters argue it “closes a loophole” that undercuts U.S. manufacturers and curbs mis-invoicing. It also aims to standardize valuation, which makes sense from a global enforcement standpoint.

A 2024 CBP bulletin explains that Last Sale is generally more consistent with how transaction value should be determined and that using First Sale can make it hard for importers to meet their duty‑valuation obligations if they don’t have access to all the details of earlier sales.

If enacted, duties will be assessed based on the final transaction value of goods entering the U.S. Which means companies would declare the $150,000 resale price in our example above.

To help us better understand how First Sale and Last Sale compare at a glance, see the table below.

Here’s the official PDF of the Last Sale Valuation Act.

Such a simple bill, but the impact is significant. Yes, this isn’t just a simple customs rule change. It’s a policy shift that affects boardroom decisions.

And the impact is on importers who purchase through multi-tier supply chains using intermediaries or trading companies.

Why It Matters

If enacted, Last Sale Valuation would:

Increase tariffs: Since duties are calculated on the final sale price, which often includes markups, tariffs are higher under Last Sale.

Increase audits: More entries will trigger detailed customs audits because higher values mean more revenue at stake for the U.S. government.

Heighten related-party scrutiny: If the buyer and seller are related (e.g., sister companies), CBP will scrutinize the price closely to ensure it's not artificially low to dodge duties.

Create documentation gaps: Importers struggle to get accurate "last sale" invoices from overseas factories or middlemen, as CBP demands a full paper trail (invoices, POs, payments) under 19 CFR 152. In CBP Ruling HQ H337689 (2025), a First Sale failed due to missing middleman freight/risk details. We might see similar issues under Last Sale.

Disrupt supply chain and sourcing: Importers may redesign sourcing, pricing, and supply chain flows to manage higher duty exposure.

Raise consumer prices: Higher duties force importers to pass costs to buyers. In fact, a report from the Federal Reserve Bank of New York says around 90% of Trump’s tariffs are paid for by American companies and consumers (more on this later).

Theoretically, this legislation could make customs enforcement easier and increase government revenue, but it may also create compliance burdens without clear wins for all parties.

And there are many questions that need answers. For example:

Who is responsible for duties when the last buyer isn’t the importer of record? How will customs handle sales where the final buyer is a marketplace or platform?

What if the last buyer refuses to share pricing docs during a CBP audit

How will CBP define an arm’s‑length last sale price? Does it include middleman profits, royalties, or manufacturing assists?

The Bill So Far and How Importers Should React

It’s too early to gauge how far this bill will go, but it has bipartisan support from members of the Senate Finance Committee. Peter Navarro, Senior White House Counselor for Trade and Manufacturing, has already voiced support for the legislation.

We can’t tell either whether Congress and the administration will pass the bill, but the fact that they have recently closed the de minimis exemption may hint at some momentum.

On the contrary, Cassidy and Senator Sheldon Whitehouse introduced a bill in 2023, the Customs Modernization Act of 2023, but it never became a law. Of course, we can never tell whether this bill will meet the same fate, but its trajectory will depend on how much bipartisan backing it gets.

On a side note, I can’t help but wonder if this is one of the U.S. government’s alternative means of imposing duties, now that Trump’s IEEPA tariffs are still being evaluated. If the tariffs are struck down by SCOTUS, the U.S. likely has a plan B. Could this be one of them?

Anyway, for companies, especially those relying on multi-tier sourcing and using intermediary or trading company structures to import their goods, it’s time to evaluate your exposure and prepare contingency plans. While the legislation is still in the early stages, it’s time to rethink your sourcing strategy, pricing models, and compliance frameworks.

“LET’S SPLIT THE BILL…90-10!”

Back in January, we shared research from the Kiel Institute for the World Economy showing that foreign exporters only absorbed about 4% of tariffs in 2025, leaving 96% to U.S. buyers.

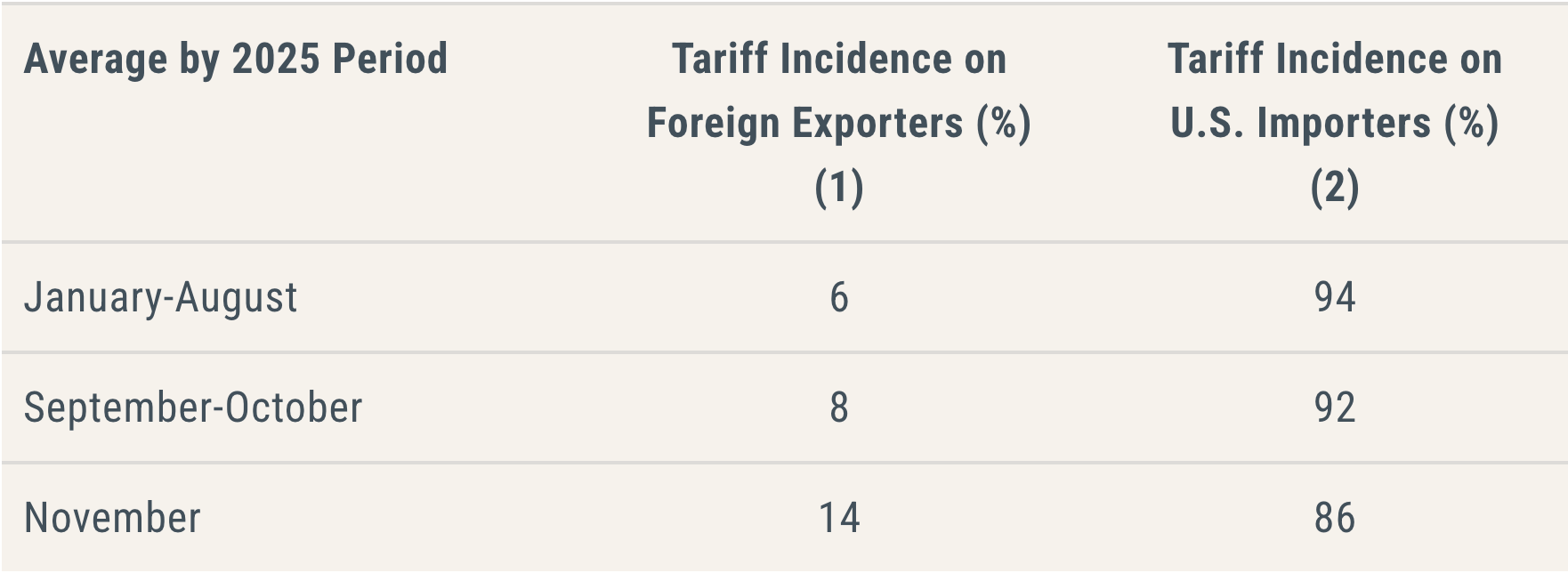

The Federal Reserve Bank of New York report we mentioned earlier confirms this trend and breaks down how the 2025 tariff burden was shared throughout the year.

January to August: U.S. importers bore 94%of the tariff burden, while foreign exporters absorbed only 6%.

September to October: Importers carried 92% of the burden, with exporters absorbing 8%.

November: Importers bore 86% of the burden, while exporters absorbed 14%.

Source: Liberty Street Economics (Federal Reserve Bank of New York)

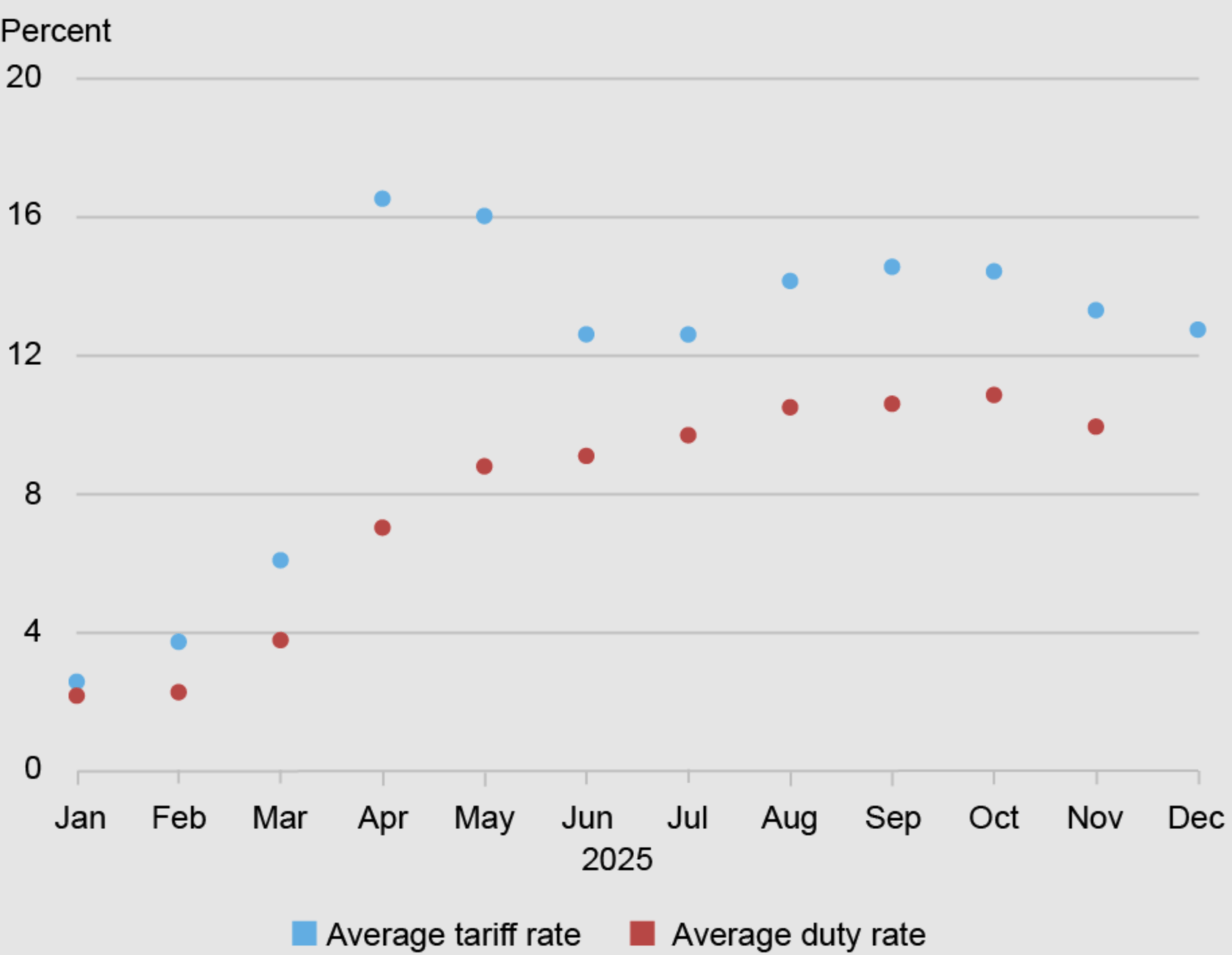

The report also sheds new light on 2025 tariff rate changes:

The average statutory U.S. tariff rate rose from 2.6% at the start of 2025 to 13% by year-end after sharp increases in April and May.

Tariffs on Chinese goods increased by 125 percentage points in April before being reduced by 115 percentage points in mid-May.

Source: Liberty Street Economics (Federal Reserve Bank of New York)

The average duty rate remained below the statutory rate due to exemptions such as the USMCA, which exempts 83% of Canadian imports from a 35% tariff.

The gap between statutory and effective duty rates peaked in April and May as importers shifted away from higher-tariffed Chinese goods.

China’s share of U.S. imports declined from nearly 25% in 2017 to around 15% in 2024 and fell below 10% in the first eleven months of 2025.

QUICK HITS ON GLOBAL TRADE

🤝 U.S. and North Macedonia Reach Reciprocal Trade Agreement. North Macedonia will remove duties on all U.S. industrial and agricultural exports, while the U.S. maintains a 15% tariff, with some products receiving a 0% rate. The deal also addresses non-tariff barriers, U.S. LNG sales, labor, environment, intellectual property, digital trade, and services.

📈 Italy-U.S. Trade Grows 7% in 2025 Despite 15% Tariffs. Italy’s exports to the U.S. rose 7.2% to €69.6 billion ($82.41 billion) in 2025, defying President Trump’s 15% tariffs, according to ISTAT, Italy’s national statistics bureau. Italy kept a $34.2 billion trade surplus, even as imports from America jumped 36%, and global trade surplus reached €50.7 billion.

🇨🇳 China Expands Tariff-Free Trade to 53 African Nations. Beijing will scrap tariffs for 53 African countries starting May 1, expanding its existing zero-tariff policy for 33 nations. Xi Jinping announced the move at the African Union summit in Addis Ababa, offering new trade opportunities, with Eswatini as the only exception.

IS DE MINIMIS COMING BACK?

A year after the U.S. ended the de minimis exemption, lawmakers have proposed the Secure Revenue Clearance Channel Act to give some low‑value shipments another route into the U.S. under a $600 threshold. This time, with lighter reporting but still subject to tariffs.

The bill, authored by Congresswoman Carol Miller (R‑W.V.) and Congressman Don Beyer (D‑Va.), aims to reduce the backlog of imports at U.S. ports by improving coordination between express carriers and CBP.

AI-generated image

If the bill passes, importers of low-value goods could benefit from a simpler or lower-duty process. However, they should also think about…

Whether it’s worth the additional uncertainty and disruption: Importers and carriers are still adjusting to the end of the de minimis exemption and new reporting requirements, so adding another clearance pathway could complicate compliance and logistics planning.

The bill is not a full return to duty-free trade. It offers a conditional path for low-value goods, but importers must stay ready for data requirements and enforcement.

FROM “NICE-TO-HAVE” TO “MUST-HAVE”

In her latest piece for Dow Jones Risk Journal, Liz Young, a supply chain reporter, shared a great summary of how trade compliance has gone from behind-the-scenes to a must-have function for companies.

Trade compliance used to be regarded as a cost center or “insurance” function in the C-suite. Today, companies recognize that these roles protect against fines, penalties, and shipment seizures while influencing procurement, supplier vetting, and import valuation.

Follow Liz Young on LinkedIn for more updates on global trade and compliance.

Source: Liz Young (LinkedIn)

WE SAVED YOU ANOTHER GOOGLE SEARCH!

Last week, we shared a Google opening for a Logistics Trade Compliance Operations Manager in Dubai. This week, Google is hiring a Trade Compliance Manager (NASA) to oversee trade compliance across North and South America.

Locations: Atlanta, GA; Addison, TX; Red Oak, TX (choose your preferred site)

Compensation: $108,000–$155,000 base + bonus + equity + benefits

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!