Brought to you by your Trade Compliance Friends.

We’ve already seen a lot in trade this year, and we’re just two months in. Where are these trends heading?

And how can businesses take advantage of these new opportunities?

In today’s sub-chapter:

📈Geopolitical pressures, sector-specific protectionism, origin-driven cost measures, and other trends

📌Best importer practices to act on the new trade shifts in 2026

💪10 insights into trade resilience in 2026 and beyond

📦How to Thrive in a Post-De Minimis World

IT’S ONLY FEBRUARY, AND YET…

I’ve already seen 30+ trade headlines on the GHY Trade Updates page, my go-to trade tracker.

Deals so far include:

BTW, Happy Valentine’s Day! 💘

Going back… tariffs aren’t slowing down either. For example, the U.S.:

Imposed 5% tariffs on semiconductors under Section 232

Ordered tariff procedures for countries supplying oil to Cuba

Declared tariffs on nations trading with Iran

From what we’re seeing so far, global trade is moving in a new direction. Buckle up!

Emerging Markets Becoming More Accessible

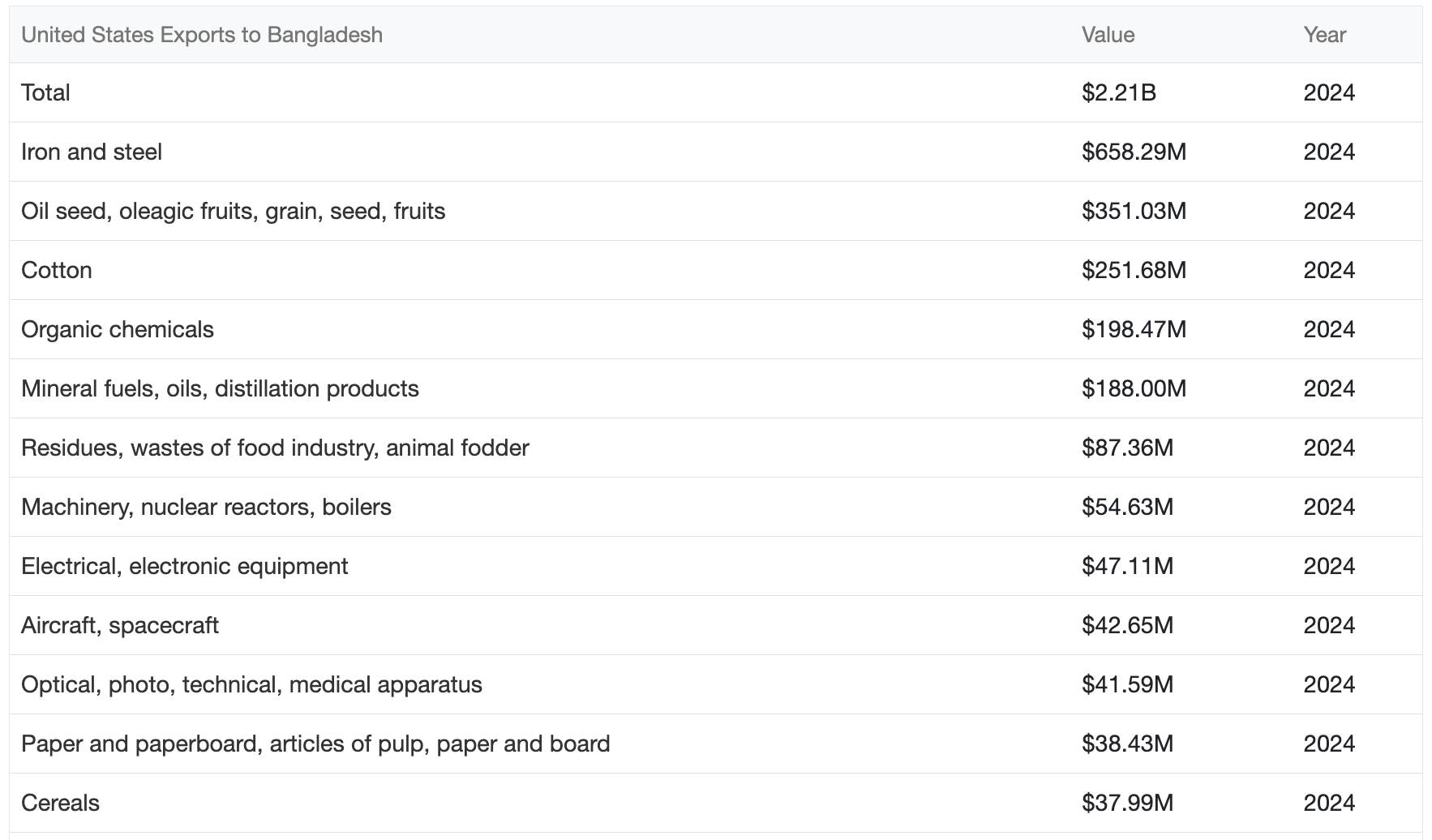

U.S. Trade Representative Jamieson Greer said Bangladesh was the first country in South Asia to complete a reciprocal trade deal with the U.S. Which is a huge step in opening new markets for U.S. exporters.

In fact, U.S. goods exports to Bangladesh were already about $2.21 billion in 2024, which means there is existing demand and commercial engagement that the new deal can build on.

Source: Trading Economics

Similarly, the U.S.–India trade deal lowers tariffs to 18 % and creates more opportunities for machinery, textiles, and energy products, while the Argentina deal opens access for U.S. beef, pork, poultry, and industrial goods.

Bilateral and Regional Negotiations

We’re seeing a rise in smaller, more targeted bilateral and regional trade agreements that create quicker, more flexible market access between trading countries. The latest multilateral framework I could remember is the WTO Joint Statement Initiative on E-commerce in 2024.

Origin-Driven Cost Pressures

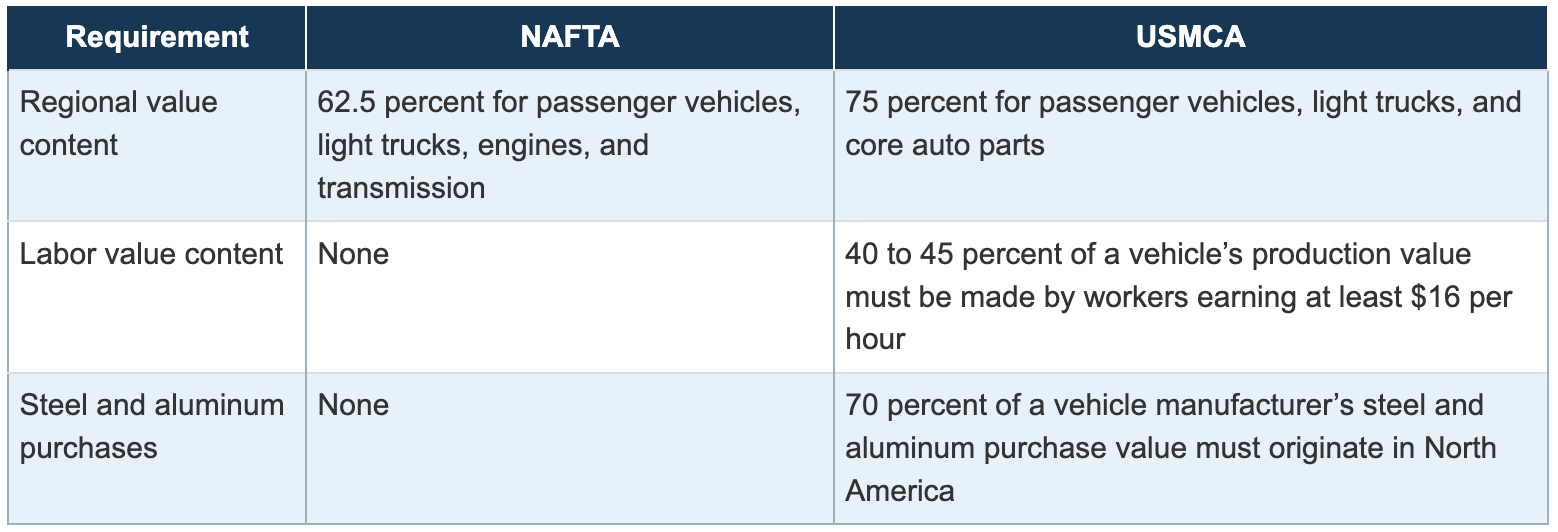

Rules of origin add to costs and supply chain complexity. Under USMCA, the regional value content for autos rose from 62.5 % (NAFTA) to 75%, with additional labor and steel requirements. The Federal Reserve estimates compliance costs add 1.4 %–2.5 % to manufactured goods, and by 2025, some companies had effectively doubled their tariff exposure.

Source: Federal Reserve

Geopolitical Pressures

New tariffs on 8 EU countries over Greenland.

25 % tariffs on any country “doing business” with Iran.

Section 232 tariffs on wood imports.

Global trade is entering an era of geopolitical fragmentation and realignment, according to UNCTAD. Countries are adjusting their trade rules and imposing tariffs based on strategic priorities, protectionist objectives… and national security (which seems to be broad enough to cover borderline goods like kitchen cabinets.)

Sector‑Specific Protectionism

Governments are increasingly using sector‑specific duties, exemptions, and carve‑outs (e.g., tech, energy, critical minerals). We’ve seen this trend in 2024–26. For instance, the U.S. has imposed a 25 % tariff on certain semiconductors under Section 232 unless they support U.S. technology supply chains like data centers.

Trade Uncertainty Itself As a Cost

Uncertainty around trade policy and tariffs adds real costs for businesses. When firms are unsure about future tariffs or their timing, they delay investment, hold higher inventories, and hesitate to commit to suppliers or long-term contracts.

In 2024, countries such as Canada, the United Kingdom, and the European Union were more exposed to U.S. policy uncertainty, even before any measures are implemented.

Source: UNCTAD

LET’S NOT CRY ABOUT IT!

So, how can businesses adapt to the trade changes and capitalize on new opportunities?

Diversify Supplier Networks to Reduce Tariff Risk. Over 65% of companies are changing sourcing patterns to reduce tariff exposure. Build supplier networks in multiple countries or regions with lower duties and trade agreements.

Renegotiate Contracts with Key Partners. Consider updating contracts to include tariff‑adjustment clauses, shared cost terms, or alternative supplier commitments.

Use Foreign‑Trade Zones (FTZs). Move components or finished goods into a U.S. FTZ where possible to defer duty payments until practical entry or eliminate duties on re‑exported goods.

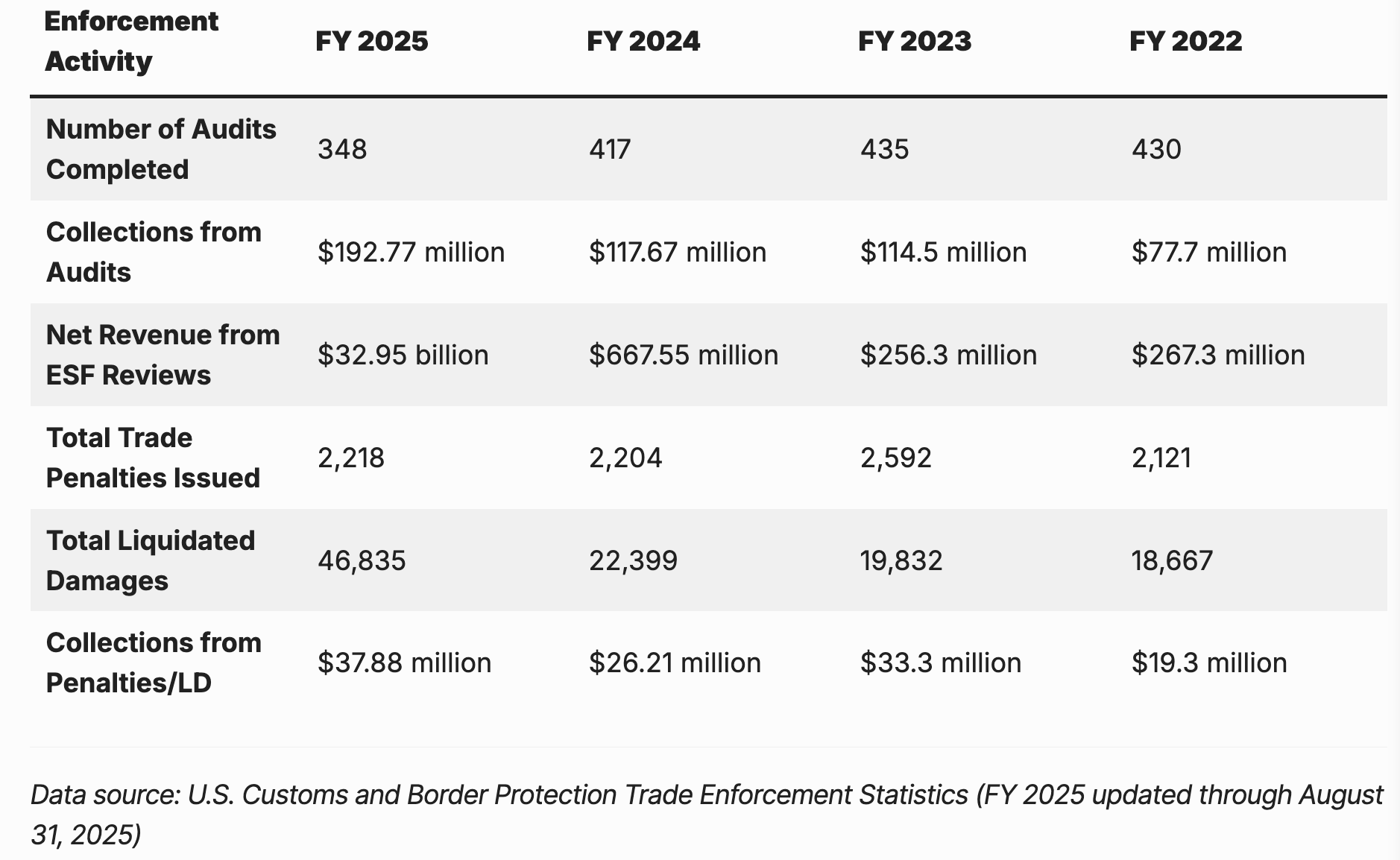

Upgrade Customs Compliance. Conduct regular customs compliance reviews to ensure accurate tariff classification, origin certificates, and documentation. Which matters because CBP continues to enforce trade laws rigorously: in FY 2025, 348 audits were completed, resulting in $192.77 million collected from audits.

Source: The World Data

Invest in Trade Technology. Deploy trade management systems that can model tariff scenarios, forecast costs, and automate compliance tasks.

Nearshore or Onshore Production. Consider moving the final assembly or significant production closer to key markets (e.g., U.S., Mexico, Canada) to avoid tariffs entirely and improve responsiveness.

Work With Customs Brokers. Customs brokers provide expert guidance on managing complex trade rules. They can monitor regulatory changes, help classify goods correctly, and ensure all documentation meets compliance 100%.

Monitor Policy. Stay on top of all trade updates by regularly tracking reliable sources, like the GHY Trade Updates page.

LOVING TRADE IN THE TIME OF TARIFFS

As we celebrate Valentine’s Day, here are 10 reasons to love global trade despite tariffs and ongoing uncertainty.

As of January 2026, the U.S. average headline tariff rate was 18%, but the effective rate, the actual duties collected, was only 9.2%.

Source: The National Institute of Economic and Social Research

U.S. and Canada are still among the largest global trading partners with strong merchandise flows reported through 2024 to early 2026.

Chinese exports to the U.S. fell 20% in 2025, but this was offset by increased shipments to Africa, Latin America, and Southeast Asia.

Higher trade barriers have affected growth but have not halted imports into large economies like the U.S. and Canada.

The dollar value of world merchandise trade hit an all‑time high in Q3 2025, which reflects robust export‑import pricing and volumes.

Even with slowing momentum, global services trade is expected to grow 4.4% in 2026.

Despite tariff pressures, Canadian imports from beyond its top trading partners rose 27.7% year‑to‑date in late 2025.

Source: Global Affairs Canada

Imports into the U.S. of high‑tech and AI‑related goods, such as semiconductors, servers and telecommunications equipment, were key drivers of merchandise trade growth in 2025.

WTO Director-General Ngozi Okonjo-Iweala said that despite U.S. unilateral actions and rising trade uncertainty, global trade has remained resilient, showing that the multilateral trading system continues to work well.

Asia and Africa are forecast to see some of the fastest merchandise export volume growth leading into 2026.

QUICK HITS ON GLOBAL TRADE

🇺🇸🇧🇩 U.S. and Bangladesh Reach Reciprocal Trade Agreement. Bangladesh lowers tariffs on U.S. industrial and agricultural goods, while the U.S. applies a 19% tariff on Bangladeshi products, with some textiles and apparel eligible for zero tariffs. The deal removes non-tariff barriers and includes $3.5B in agricultural and $15B in energy deals.

🇺🇸🇮🇳 U.S. and India Agree on Interim Trade Framework. India will reduce or eliminate tariffs on U.S. industrial and agricultural goods, while the U.S. applies an 18% tariff on select Indian products. Additionally, the U.S. removed the additional 25% tariff imposed on Indian goods for Russian oil purchases. New Delhi has pledged to stop directly or indirectly importing Russian oil.

🇨🇦 CBSA Updates Mass Adjustment Submissions. CBSA’s Customs Notice 26-03 updates mass adjustment rules effective February 2, 2026. Form BSF987 is now mandatory, mass adjustments apply only to CADs in CARM, and up to three reason codes may be used. Non-compliant submissions will be rejected, and time limits will not be protected.

🛑 Trump Orders Tariffs on Countries Trading with Iran. President Trump authorized additional tariffs on countries that trade directly or indirectly with Iran. U.S. agencies will identify qualifying nations, recommend rates, and enforce the measures. Tariffs may be adjusted based on retaliation, policy changes, or Iran’s behavior.

POST-DE MINIMIS GAMEPLAN

U.S. Customs processed about 1.36 billion duty‑free, low‑value parcels in 2024. That’s millions of small shipments every day.

Until the de minimis exemption ended in August 2025.

At a recent event by Supply Chain Dive and Retail Dive, experts shared four ways to thrive in a post-de minimis world.

Gather Your Data. No more guessing. Customs now wants full info: 10-digit HS codes, country of origin, and clear product descriptions.

Protect Your Margins. Know your costs, price smartly with landed-cost data, and work with logistics partners to optimize inventory in the U.S.

Team Up with a Customs Pro. Rules now vary by product composition and origin. A trusted customs partner helps you pay what’s due: no more, no less. Review SKUs, focus on a core catalog, and rationalize product lines.

Negotiate Shipping Rates. Work with carriers and providers to get the best rates. Analyze your supply chain to identify cost-saving opportunities. A more intelligent, proactive approach now pays dividends throughout the year as challenges evolve.

Clear Small Parcel Shipments Faster with GHY eBiz

Under new rules, CBP‑approved qualified parties can collect and remit duties on international mail. GHY eBiz, added to the list of qualified parties in January 2026, helps importers clear small parcels with digital customs, landed-cost calculations, and streamlined logistics.

IT DOESN’T CREATE RELIEF. IT MAKES IT USABLE.

In her latest LinkedIn post, Sonali Thukral, a global trade compliance expert, shares that Customs Notice 26‑02, along with the Surtax on Imports of Certain Steel Goods Remission Order (2025), doesn’t create new relief but “makes it practical”.

The notice, according to her, sets clear expectations for documentation, schedule matching, proof of transit, and a two-year claim window.

Which turns uncertainty into a process. This change provides a “legitimate path to recover surtaxes that would otherwise be sunk costs.”

Follow Sonali on LinkedIn for more global trade insights, or reach out for guidance on remission claims and steel import compliance.

And speaking of steel imports, GHY recently released a comprehensive guide to Canada’s TRQs and the 25% steel derivative surtax, which covers everything from documentation to reporting requirements.

Source: Sonali Thukral

WE JUST SAVED YOU A GOOGLE SEARCH!

Google needs a Logistics Trade Compliance Operations Manager to oversee trade compliance across the Middle East (UAE, Saudi Arabia, Kuwait).

Location: Dubai, UAE

Requirements:

Bachelor’s degree or equivalent experience in trade compliance operations

5+ years in customer-facing logistics roles

Fluent in Arabic (for local stakeholder engagement)

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!