Brought to you by your Trade Compliance Friends.

Happy New Year! Good news for furniture manufacturers and retailers and Italian pasta makers!

Trump has just delayed furniture tariff increases and rolled back proposed duties on Italian pasta, easing some of the pressure from 2025 tariffs.

In today’s sub-chapter:

🛋️Trump delayed furniture tariff hikes to January 1, 2027

🇺🇸A timeline of the U.S. trade and tariffs in 2025

🌐Top trends from a 2026 Global Trade Report

⚖️U.S. Supreme Court schedule for Trump’s IEEPA tariff decision

NEW CRACKS IN THE TARIFF WALL IN 2026

Remember when we said Trump’s tariff wall might have finally cracked when he rolled back tariffs on 200+ ag products in November 2025?

Looks like these cracks are starting to show up and are getting wider.

Trump’s government has just started the year with tariff delays and adjustments for food and consumer goods. Trump postponed the January 1, 2026, increases on furniture imports and has also rolled back proposed anti-dumping tariffs on Italian pasta.

Furniture tariff would have increased to 30% on upholstered furniture and 50% on kitchen cabinets and bathroom vanities, respectively, starting Jan. 1, 2026. Now the 25% remain through this year.

Trump rolled back proposed Italian pasta tariffs, initially as high as 92%, cutting them to 2.26% for La Molisana, 13.98% for Garofalo, and 9.09% for 11 other producers.

These adjustments offer a short-term relief for businesses and households. But what might have made Trump reverse these tariffs?

Maybe he has realized that sofas aren’t national security threats after all? He had already imposed higher tariffs on steel, aluminium, copper, and cars, in the name of national security, but many experts say he overstretched Section 232 on furniture imports. Or maybe he already acknowledges that Americans love Italian pasta and that the US can’t make it home?

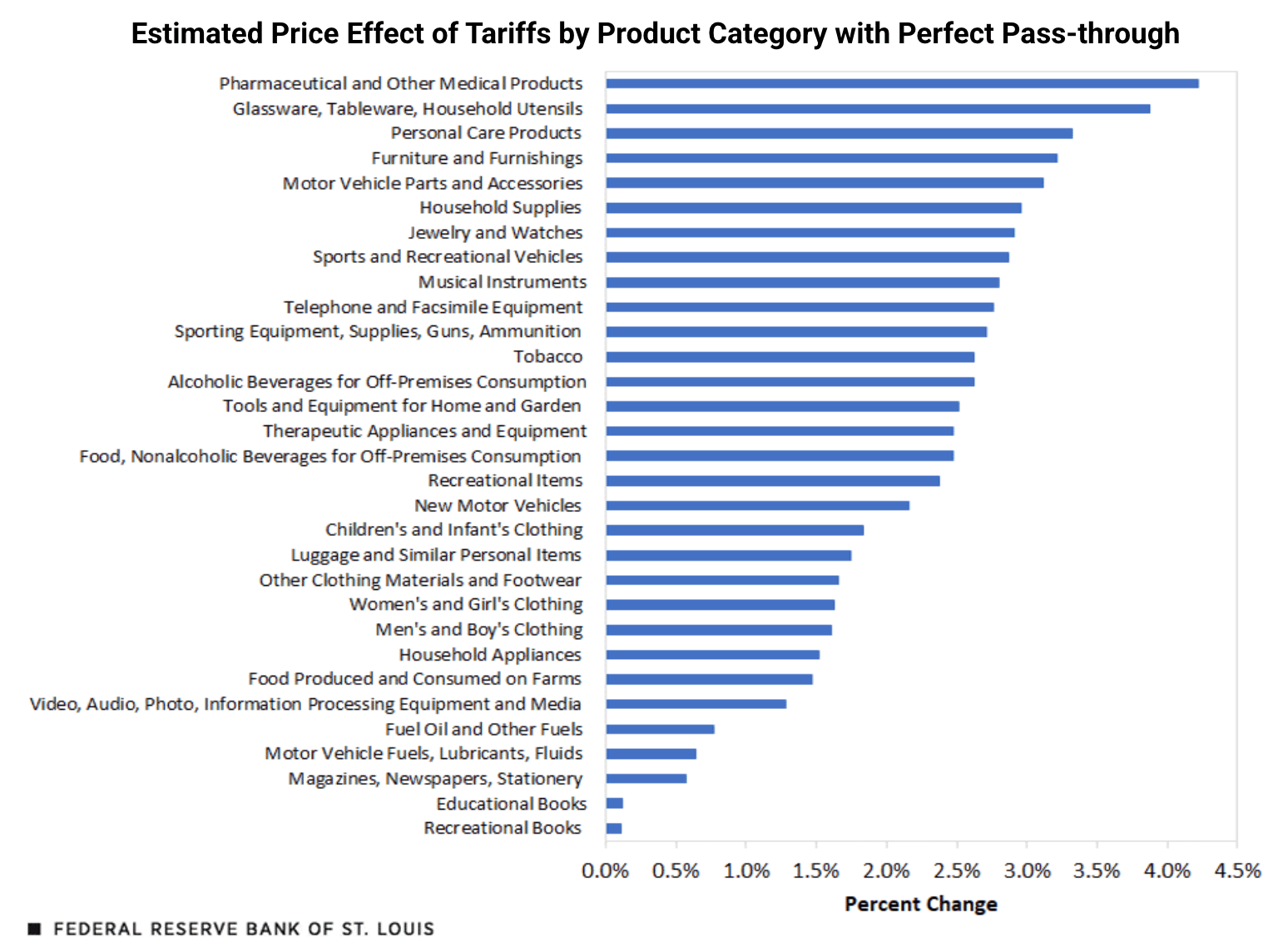

Or has he probably realized tariffs were making shopping carts lighter for many American consumers? Tariffs in 2025 reportedly contributed to higher prices for U.S. consumers. According to the St. Louis Federal Reserve, tariffs added about 0.5 percentage points to overall inflation and accounted for roughly 11% of the increase in consumer prices over the year.

In fact, furniture are among the most affected by tariff‑related price increases. Meaning, consumers were paying more for these items as companies passed import costs onto shoppers.

Source: Federal Reserve Bank of St. Louis

Which is a big deal because U.S. furniture imports reached $25.5 billion in 2024, up from 2023. That’s a lot of couches, cabinets, and vanities on their way to American homes.

It’s far from clear if the furniture tariffs postponements will significantly affect inflation in 2026, but they definitely provide relief for many. After the tariff announcement, Wayfair shares rose 4%, Williams-Sonoma gained 2%, and RH climbed 5.5%. This just shows how sensitive the market is to trade policies.

Another theory is that Trump’s just been using these threats as bluffs all along to put pressure on trading partners into concessions. Many announced threats in 2025 never actually materialized (compiled some of them in a LinkedIn post).

This one’s a bit more bizarre, but Trump could also just be using the tariff increase as a setup to make the existing 25% more palatable to partners. This makes me remember my psychology lesson about the door-in-the-face technique. You ask for too much, get a no, then the smaller ask feels like a win. Now, 25% is more palatable. Clever, if that’s true!

Anyway, what matters is that these tariff retreats provide furniture manufacturers and retailers and Italian pasta makers with temporary relief.

The drawback is that it also prolongs the ongoing policy uncertainty. Which is why businesses have to be smarter in 2026. Again, let’s not forget, tariffs are still here. Companies should take advantage of these tariff adjustments to plan early, diversify their material sources, and build more resilient supply chains.

Let’s hope that these tariff retreats are just the first of many as we head into 2026. And who knows, maybe 2025 has taught Trump that tariff isn’t always the best trade policy.

2025 WAS THE YEAR OF TARIFFS

Ambassador Jamieson Greer called 2025 “the year of the tariff” in a December 22 Financial Times op‑ed. Let’s take a look back at what happened last year in U.S. trade and tariffs.

Jan 20: Trump inaugurated. "America First" memo directs agency trade reviews by Apr 1.

Feb 1: IEEPA orders target immigration/drugs. Effective Feb 4: 25% Canada/Mexico imports, 10% Canadian energy/China. Ends China de minimis via opioids EO.

Feb 3: Pauses Canada/Mexico IEEPA to Mar 4. Countries add border security.

Feb 4: Enforces 10% China tariffs (no duty drawback).

Feb 5: Amends opioids EO; some China de minimis retained pending rules.

Feb 10/Mar 12: Section 232 25% steel/aluminum tariffs. No Canada/Mexico/EU exemptions.

Feb 13: Reciprocal tariffs policy to match foreign rates (e.g., Brazil ethanol, India motorcycles).

Feb 25: Section 232 copper probe ordered.

Mar 1: Section 232 timber/lumber probe; domestic production EO.

Mar 4: Canada/Mexico IEEPA starts (25% non-energy, 10% energy). China IEEPA to 20%.

Mar 7: USMCA-compliant goods exempt from IEEPA. Potash to 10%.

Mar 24: Announces autos/pharma tariffs. 25% on Venezuela oil importers (Apr 2).

Apr 3: Section 232 25% on autos/light trucks (sedans, SUVs, vans).

Apr 5: Reciprocal IEEPA 10% baseline (exempt: USMCA, Section 232 items, Annex II).

Apr 9: Country-specific reciprocal rates begin.

Apr 10: Pauses most at 10%; China briefly 125%.

Apr 11: Semiconductor exemptions added (retro Apr 5).

Apr 16: Section 232 probes: pharma/APIs, semiconductors/SME.

Apr 18: China/HK de minimis ends May 2 (formal entry required).

Apr 24: EO/Section 232 on critical minerals (nickel, cobalt, etc.).

Apr 25: Section 232 trucks probe. CBP raises informal entry limit to $2,500.

May 2: China/HK de minimis fully ends.

May 3: Section 232 25% auto parts (engines, transmissions).

May 12: China reciprocal adjusted to 34%, paused 90 days.

Jun 3: Steel/aluminum Section 232 to 50%; expanded reporting.

Jun 13: Aluminum unknown origin: UNK/200% duty.

Jul 7: Reciprocal rates extended to Aug 1.

Jul 28: US-EU deal: 15% cap (steel/alum/copper remain 50%).

Jul 30: Brazil IEEPA 40% (Aug 6). Copper Section 232 50% (Aug 1). Global de minimis suspended (Aug 29, tiered postal fees).

Jul 31: Country rates effective Aug 7 (excl. China). Northern border IEEPA to 35%.

Aug 6: India IEEPA 25% re Russian oil (Aug 27).

Aug 11: China reciprocal paused at 10% to Nov 10.

Aug 16: 50% Section 232 on 407 steel/alum derivatives (Aug 18).

Aug 18: CBP Section 321 $800 daily aggregate enforced.

Aug 25: India 25% confirmed.

Aug 29: De minimis ends for non-postal low-value goods.

Sep 4: US-Japan 15% baseline (retro Aug 7).

Sep 5: Reciprocal Annex II updated (Sep 8).

Sep 29: Section 232: Lumber 10%, furniture 25-30%, cabinets 25-50% (Oct 14).

Oct 27: Asia-Pacific deals (Cambodia etc.).

Nov 1: Section 232 trucks 25%, buses 10%.

Nov 3: US-China: Fentanyl to 10%, reciprocals to Nov 2026, Section 301 extensions.

Nov 13: 237+ ag exemptions; Brazil ag tariffs removed.

Nov 14: Latin America/Switzerland/Liechtenstein frameworks.

Nov 17: US-South Korea 15% cap (retroactive elements).

Dec 1: US-UK pharma 0%.

Dec 6: US-Korea deal implementation CSMS.

Dec 11: Nicaragua Section 301 phase-in 0-15%.

Dec 17: Switzerland guidance.

Dec 31: Delays furniture tariff increase to Jan 1, 2027

2026: YEAR OF TARIFF CONSEQUENCES

If 2025 is the year of tariffs, then 2026 is the year of tariff consequences.

According to market analysts, the delayed effects of Trump’s tariffs will be more visible in 2025. In fact, the World Trade Organization now forecasts world merchandise trade volume growth at only about 0.5% in 2026, down from about 2.4% in 2025.

Source: World Trade Organization

The impact is already visible in key markets. Copper prices, for example, have surged past $13,000 per metric ton, partly fueled by traders rushing metal into the U.S. ahead of potential import duties. That rush pushed prices more than 20% higher since late 2025 and has changed global shipment patterns.

Meanwhile, countries like China imposed new barriers, too. Starting January 1, 2026, China put a 55% tariff on beef imports above quota levels to protect its domestic industry, and this is expected to cut Brazilian and Australian shipments and trim export revenues by billions.

Economists say the high tariffs from 2025 are partly responsible for slower global growth. The World Bank lowered its GDP forecasts for 2025 and 2026, pointing to rising trade barriers and uncertainty. In 2026, growth is expected to remain below earlier estimates as tariffs continue to limit trade and investment.

Needless to say, tariffs also raise costs for businesses and consumers. Higher import duties often translate into higher prices, tighter profit margins, or shifts in sourcing. Export-dependent economies feel the pressure as demand weakens and global production costs rise.

For businesses and decision-makers, 2026 will test the adaptability of your global trade systems under these tariff pressures. Make sure to assess the lingering effects of 2025 tariffs on your costs, supply chains, and market access, and develop strategies that can absorb disruptions, protect margins, and keep operations agile in this uncertain trade environment.

QUICK HITS ON GLOBAL TRADE

🇨🇦 Canada Releases List of Steel Derivative Products Subject to 25% Tariff. Last month, Canada released a detailed list of steel derivative products that will face a 25% tariff starting December 26, 2025. The list includes prefabricated buildings, bridges, towers, wires, chains, fasteners, furniture, lighting, springs, and specialized forged or cast items, with exemptions for in‑transit goods, vehicles, aircraft, energy projects, and regulated items.

🇮🇳 Trump Warns India on Trade Pressure. Trump warned India it could face higher tariffs if it doesn’t curb Russian oil purchases, saying PM Modi “knew I was not happy” and acted to appease him. Despite cutting imports below 1 million barrels per day and boosting U.S. exports, trade talks have stalled. Will we see India yield, or will it defend its energy independence against looming tariffs?

🇨🇳 China Demands U.S. Lift Tariffs. Beijing called for the cancellation of all U.S. unilateral tariffs, saying no trade talks have taken place despite U.S. claims. The Trump administration is reportedly considering reducing duties on Chinese imports from 145% to 50–65%, signaling a potential step toward easing the ongoing trade war.

💵 Trump Claims US Will Collect Over $600B in Tariffs. President Trump said the US has already collected, or will soon collect, more than $600 billion from tariffs, calling the policy a boost to the country’s finances and national security. He criticized the media for downplaying the issue ahead of a key Supreme Court decision.

WHAT MATTERS TO 200+ TRADE PROS IN 2026?

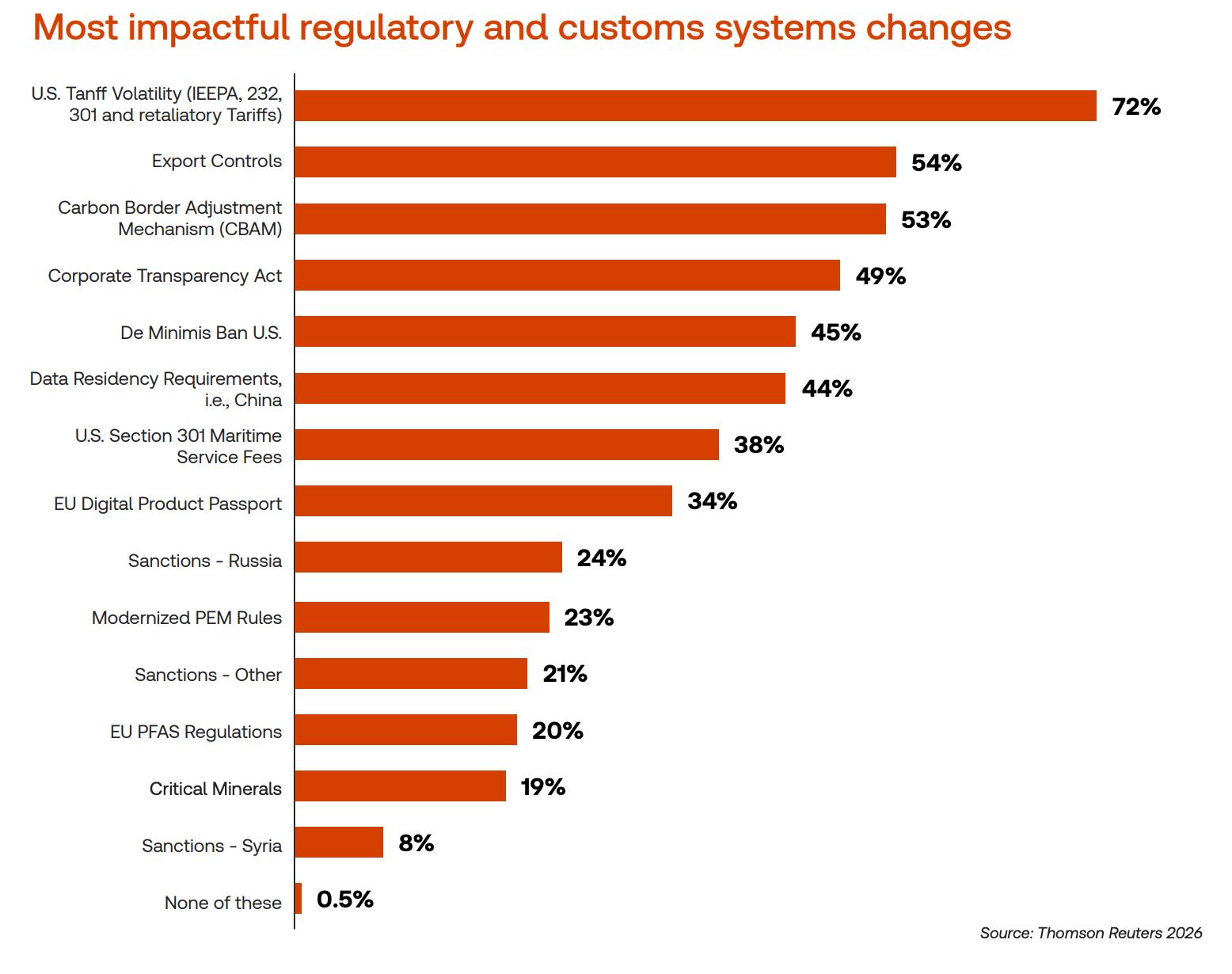

It’s 2026, and it’s the year to rethink your global trade strategy. The 2026 Global Trade Report by the Thomson Reuters Institute, based on a survey of 225 trade professionals, shows some eye openers:

72% see U.S. tariff volatility as the most impactful challenge, up from 41% last year.

76% expect U.S. tariffs to last at least four years.

68% rank supply chain management as their main priority

43% gain more say in procurement due to trade issues.

39% absorb tariff costs internally, up from 13% last year.

65% adjust sourcing to cut tariff risks.

58% use data analytics for trade, with 56% using ERP systems.

33% list regulations as a key priority, up from 21%.

51% pursue nearshoring to the U.S.

Source: Thomson Reuters Institute

So, what’s happening here? Companies need to strengthen their supply chain management by mapping risks, diversifying their suppliers, and building buffer stocks to manage frequent disruptions caused by tariffs and shortages.

It’s also a good time to develop multi-year compliance strategies, select duty-advantaged vendors, and revise sourcing by moving away from high-tariff origins.

Support your teams with advanced systems, such as GHY Classify for accurate tariff and HS classification, electronic data interchange solutions, and risk monitoring tools. Embed regulatory monitoring into your core operations, with dedicated reviews of U.S. tariff updates like Section 232 or 301 actions.

And with tariff volatility still a major challenge, customs professionals are playing an increasingly important role in guiding these strategic decisions and ensuring compliance.

TRUMP’S IEEPA TARIFFS ON THE CLOCK

As Trump’s IEEPA tariffs remain in limbo, everyone is watching closely as SCOTUS could issue a ruling any day now. And with the expedited review, here’s what the U.S Supreme Court schedule looks like for the IEEPA tariff decisions:

Oral arguments held early November 2025: The Court heard arguments on November 5, 2025, challenging the legality of the emergency tariffs imposed under the International IEEPA.

Decision expected early 2026: Most legal analysts expect the Court to issue a ruling by early 2026 (possibly January or February), given the expedited schedule. The Court’s term technically runs until June 2026, so a ruling could come any time before then.

Court could rule “this Friday”: The Supreme Court has reportedly set Friday as an opinion day, so we might see a decision by then.

Why does the SCOTUS ruling matter? The Court’s decision could define how far the executive branch can go in setting tariff policy without congressional action and will influence global trade planning throughout 2026 as companies and policymakers adjust to the ruling.

How might the Court decide? Experts estimated about a 70–80% chance that the Supreme Court will rule against Trump’s tariffs. Even prediction markets agree. As of this writing, Polymarket and Kalshi give a 22% and 31% chance, respectively, that the Supreme Court will side with Trump’s IEEPA tariffs.

Source: Polymarket

7,000+ SHIPMENTS STOPPED. IS YOUR TEAM READY?

Over 7,000 shipments. More than $160 million in goods. All stopped by CBP under laws like the Uyghur Forced Labor Prevention Act (UFLPA).

If 2025 taught us anything, it’s that forced labor enforcement is very real…and very expensive. Hundreds of importers got caught off guard, scrambling to produce documentation while shipments were held.

Source: CBP

So what should 2026 look like? Proactive, prepared, and strategic. Companies need to know their supply chains, vet suppliers carefully, and keep records that can survive a CBP review.

To support importers and trade teams, CBP launched the Forced Labor Portal, a centralized tool for submitting review requests, from Withhold Release Orders to UFLPA applicability and exceptions. And this mid-January, CBP is hosting three webinars to train importers on using the Portal.

This is your chance to get hands-on guidance, see the portal in action, and make sure your trade teams, customs professionals, and brokers are ready.

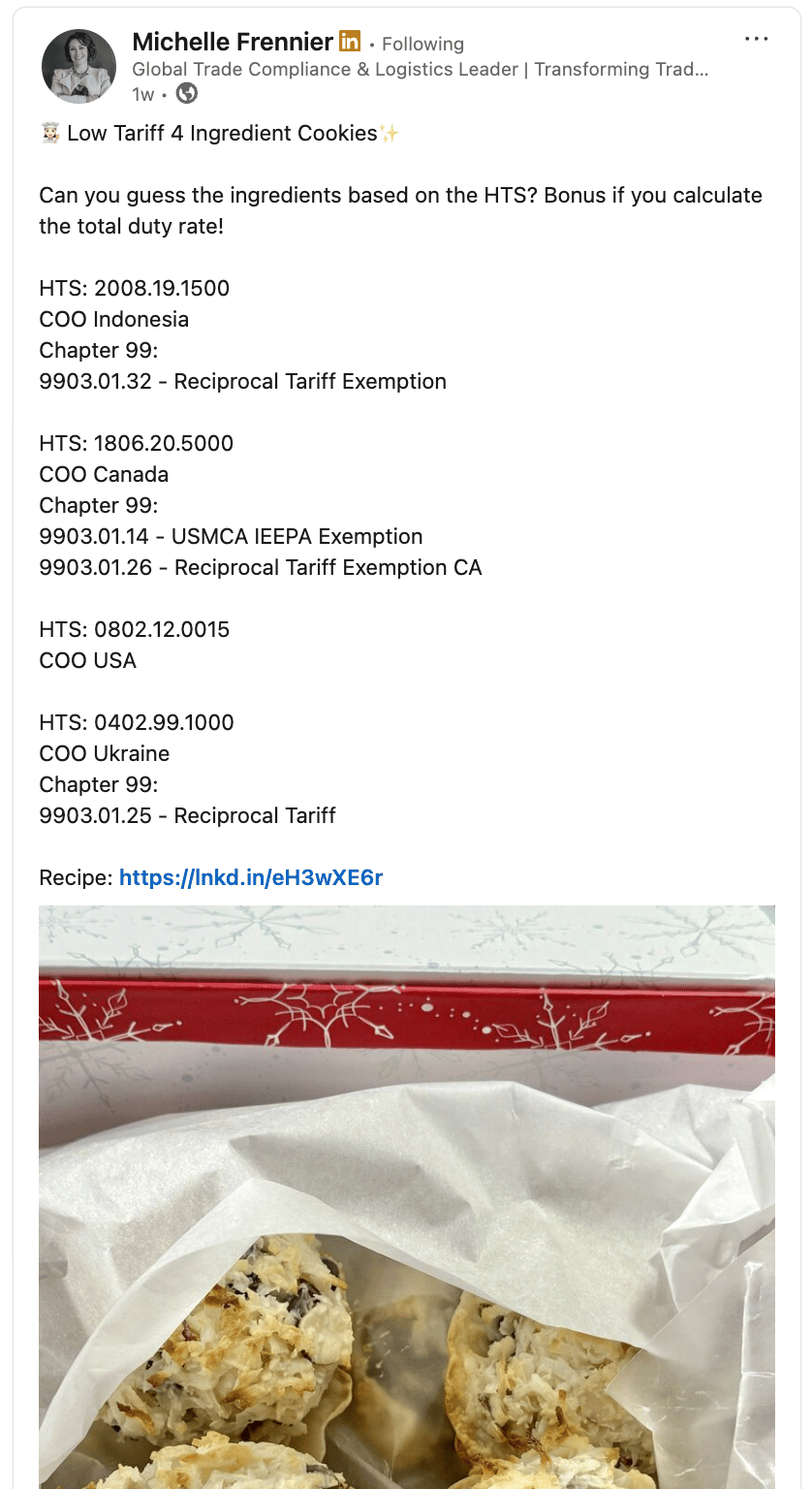

LOW-TARIFF 4-INGREDIENT COOKIES

For sharp insights on global trade and supply chain, Michelle Frennier, a global trade compliance and logistics expert, is one to follow. She loves to turn complex regulations into actionable guidance, and sometimes into a fun challenge. Try her “Low Tariff 4-Ingredient Cookies” HTS code guessing game to test your trade knowledge.

Source: Michelle Frennier (LinkedIn)

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!