Brought to you by your Trade Compliance Friends.

Canada is building a tariff wall around its steel market. Is it a solution or a complication? Or a response to Trump’s tariff wall?

In today’s sub-chapter:

🇨🇦 Can Canada’s new tariffs on steel derivatives really support and protect domestic mills?

✍️ CBSA seeks consultations on previously proposed changes to the Valuation for Duty Regulations

🔍 How can a customs broker help reduce risks under Canada’s 25% tariff on steel derivatives?

😮 Roomba maker files for bankruptcy

CANADA’S TARIFF WALL, BUILT ON STEEL

It’s only a few days into 2026, and Canada seems to be busy building a tariff wall around its steel market. Ottawa has taken a series of steps to protect the domestic steel industry, including imposing a 25% global tariff on steel derivatives and reducing TRQ levels from 50% of 2024 to 20%.

Remission requests can be made on a case-by-case basis, such as when goods aren’t available domestically or when the tariff would significantly harm the Canadian economy.

Last week, Canada shared the list of steel derivatives that are subject to the 25% tariff. Examples include doors, windows, chains, fasteners, wires, and cables.

These measures are meant to limit imports of foreign steel in the country. In fact, China’s exports of iron and steel to Canada alone reached US $437.1 million in 2024.

Source: Data from United Nations COMTRADE as reported by Trade Economics

But again, let’s clarify. It’s a 25% global tariff, not just on the U.S. I wanted to point this out because 40% of items on the list are typically imported from the U.S., according to a Canadian government official. And Washington, whether we like it or not, is lurking in the background for all of this (more on this later).

Lifeline for Domestic Steel Makers

Anyway, these protectionist measures are good news for many Canadian steel producers, especially those who have been hit hard by Trump’s tariffs. In June 2025, Trump increased the 25% to a 50% tariff on all countries, except the U.K.

Canadian Steel Producers Association CEO Catherine Cobden said that Trump’s tariffs are crushing the Canadian steel industry. “At a 50% tariff rate, the U.S. market is effectively closed to Canadian steel, leaving billions of dollars of Canadian steel without a market,” she explained.

Looking back at the 2024 data, it wasn’t looking good for these steel producers. Last year, Canadian steelmakers were able to export only just over 50% of their annual production, and 90% of these went to the U.S.

And guess how many entered Canada in 2024? 8.3 million metric tonnes of steel, mostly from the U.S., China, and South Korea. So, to say the least, the 25% tariff is a lifeline for many domestic steelmakers.

Can Canada Supply Enough Steel?

Rail costs, one of the biggest pressure points for steel users outside Central Canada, will likely ease once Ottawa rolls out heavy rail subsidies in the federal budget. That changes the math for regions like Western Canada, where transportation costs, not just steel prices, drive sourcing decisions. If rail support materializes at scale, the gap between domestic and imported steel narrows faster than critics assume.

The bigger concern now lies with capacity. With the 25% tariff in place and added support flowing to domestic mills, can Ottawa make enough steel on its own to supply all sectors and product categories without relying on imports?

You’ve Built A Tariff Wall. I’ll Build Mine.

Anyway, going back to the U.S., which I earlier mentioned, is in the background of all these moves. Carney has been known to be patient with Trump, with the hope of finally getting a good deal and extracting concessions like relief from U.S. steel tariffs. But until now, nothing is settled yet.

Could it be that Carney is done with putting up with Trump’s discontent? Is he fed up with U.S. intransigence?

If I could look at it metaphorically, Carney is sending a message to Trump: “You’ve built a wall. I’m building mine. If you want trade talks, lower your wall, and I will lower mine.” These moves may be more than bluffs against the U.S., but we can’t deny that the result is a double-edged sword: protection helps domestic producers, but it causes uncertainty for foreign steel buyers and users.

Carney seems to be doubling down on his trade diversification game, but it’s not going to be that easy. U.S. goods imports from Canada were $260 billion in the first eight months of this year, about 5% lower than the same period last year, according to U.S. Commerce Department data. It would take a while to find other stable markets.

And the U.S. pressure on other trading partners will also be a challenge, as other countries seem to accept one-sided agreements. For example, South Korea reached an agreement that sets a 15% tariff on its exports to the U.S. while Seoul agreed to extensive market access for U.S. goods and investment commitments. The EU agreed to 15% tariffs on its exports while removing its own tariffs on most goods to zero. Carney will definitely have a hard time matching these terms.

Are There Any Less Damaging Options?

Not an expert here, but aren’t there any gentler tools to support Canada’s local industry? For example, the government could focus on specialized programs tied to government procurement and public infrastructure and provide targeted support for Canadian mills. Or maybe Carney could grant regional exemptions to Canadian suppliers based on their local geography and the construction market in those areas.

These would be, uhm, less damaging, but again, it’s easier said than done.

Anyway, whether these trade measures are a solution or a complication is uncertain. But no matter what, let’s hope Carney gets what he’s trying to achieve for Ottawa, whether it’s a domestic home for Canadian steel, Trump’s concessions, or both.

CBSA PANIC BUTTON IS PRESSED

The Canada Border Services Agency is reviving its long-debated “last sale” proposal. Yes, the one everyone thought was buried in 2023. This time, it’s back with revised language: clearer carve-outs for Canadian resident importers.

CBSA reopened consultations on December 3, 2025, with comments due by January 23, 2026.

At a basic level, the proposal shifts customs valuation away from the first sale in a supply chain and toward the final sale that triggers export to Canada. This sounds technical, yet the financial impact can be immediate and significant.

What is the Last-Sale rule?

Currently, duties are calculated on the supplier’s price. Let’s say $10 per shirt. Under the revised “last sale” rule, CBSA could base duties on the resale price instead, such as $50 charged by a wholesaler to a Canadian retailer. Meaning? For 100 shirts, that’s $1,000 versus $5,000 in duties, and the result: your costs go up, and prices could rise for shoppers.

Based on the CBSA guidance, Canadian residents are explicitly protected. Foreign non-residents get hit. So yes, the goal is noble: make rules fairer so foreign sellers don’t get an advantage with unusually low prices.

But There Are Gray Areas

There are eight substantial presence conditions to determine whether an importer qualifies as a purchaser in Canada. But there are no hard thresholds.

For example, one of the substantial presence conditions is: having its primary place of business physically located in Canada, which cannot be met through the use of a branch or agent. Does primary mean the biggest office by square footage, staff count, or where imports happen?

Another rule: having decision-making power over the day-to-day operations in Canada. Local managers may recommend purchases, but if the final approval comes from a foreign parent company, will that disqualify the Canadian office?

It looks like the ambiguity in these conditions will make it difficult for businesses to predict how auditors will apply the rules.

Tracking the Pain Points

A huge worry among importers is the added compliance burden. Companies may have to spend money on customs software, professional fees, and internal compliance resources. E-commerce sellers face more hurdles since they need to track and document every single online order that triggers an import, including emails, invoices, and payment records.

Also, auditors often request detailed pricing data and customer records, which can potentially expose sensitive commercial information. Unless companies use protections like the U.S. Electronic Vessel Manifest Confidentiality program, this data could be exposed to competitors.

And in the first place, why didn’t the CBSA share the full rule text for everyone to read and comment on first? This means stakeholders will be commenting based on merely summaries. How will importers precisely understand the consequences of the changes and provide accurate feedback?

Also, there’s no indicated transition period, so it could become law immediately. How will businesses implement compliance changes to their paperwork and software?

Clearly, among the most predictable impacts of the last-sale rule is a significant cost increase across supply chains, which creates multiple pain points for importers. First, as mentioned earlier, it will potentially multiply duty costs several times over. This leads to cash flow pressures, higher landed costs, and tighter margins. These costs flow downstream: wholesalers, retailers, and ultimately consumers may see higher prices as importers pass on the increased duties through the supply chain.

Clear Guidance Matters

So, yes, the rules are still fuzzy in key areas despite the revised guidance. Importers need numerical thresholds, worked examples, and detailed policy memos.

Also, it’s a critical time to strengthen customs compliance. Importers should review their supply chains to identify the final export sale, calculate potential tariff increases, and assess operations against the ambiguous substantial presence conditions.

Industry groups like IE Canada are offering guidance and an opportunity to share feedback while the consultation is open.

STEEL YOURSELF WITH A CUSTOMS BROKER!

Canada’s new 25% surtax on steel derivative products affects not just raw steel but a wide range of downstream goods: from metal furniture to structural components. Coupled with MFN duties, SIMA measures, and ongoing remission orders, the risk to landed costs and supply chains has never been higher. Companies can’t afford to wait and react: they need a proactive strategy.

This is where a customs broker like GHY International can help.

HS Classification and Product Mapping

Small changes in design or tariff heading can mean the difference between paying nothing and a 25% surtax. A customs broker helps by:

Re‑checking HS classifications line-by-line against the published derivative list

Mapping products to the correct HS codes

Providing advance ruling strategies and SKU-level risk heatmaps

Remission Strategy and Applications

Where steel inputs aren’t available domestically, remission can reduce the surtax burden. A customs broker assists by:

Scanning for eligible remission opportunities

Building dossiers with costing, sourcing evidence, and technical specs

Drafting, managing, and tracking remission applications and approvals

Origin, FTAs, and “Tariff Treatment 2” Clean-Up

Many importers relied on MFN duty-free treatment historically. Your customs broker turns that into a deliberate origin strategy:

Validating product origin

Refreshing CUSMA and other FTA certificates

Ensuring preferential treatment is properly claimed and documented

Duty Drawback and Export-Linked Relief

For goods that are exported or incorporated into exports, a customs specialist helps recover part of the surtax:

Assessing eligibility for duty drawback or export-linked relief

Designing tracking processes from import to export

Preparing claims and supporting documentation

Pricing, Contracts, and Supply-Chain Re-Design

The 25% surtax reshapes costs and sourcing decisions. A customs broker supports companies by:

Modelling landed costs and scenario analysis by supplier, HS code, and sales channel

Advising on vendor negotiations and alternative sourcing

Helping redesign products to fall outside derivative HS coverage

P.S. GHY International is hosting a live Q&A this Friday to walk importers through Canada’s new 25% steel derivative surtax: covering HS classification, remission strategies, origin rules, and supply-chain tips. Don’t miss your chance to get expert guidance and ask your questions live.

QUICK HITS ON GLOBAL TRADE

💻 U.S. Pauses $40B U.K. Technology Deal. The United States paused implementation of a $40 billion U.S.–UK technology agreement covering AI, quantum computing, and civil nuclear energy. U.S. officials cited concerns over the U.K.’s digital regulations and food standards. The Tech Prosperity Deal includes cooperation on advanced technologies and major investment pledges from Microsoft, Google, Nvidia, and OpenAI.

🇨🇭Swiss Growth Forecast Rises After U.S. Tariff Cut. Switzerland raised its 2026 economic growth forecast to 1.1% after a U.S. agreement lowered tariffs on Swiss products from 39% to 15%. The reduction provides better conditions for exporters and trade, while domestic demand continues to drive growth. Risks remain from global uncertainty and a strong Swiss franc, though 2027 growth is expected to improve.

🤝 Indonesia Targets Year-End Completion of U.S. Tariff Deal. Indonesia expects to finish tariff negotiations with the U.S. by the end of the year. The deal would lower U.S. tariffs on Indonesian products from 32% to 19% and remove non-tariff barriers, with Jakarta confirming talks are continuing as planned.

🇨🇦 Canada Seeks Input on Four New Trade Deals. Ottawa opened public consultations on four free trade negotiations: the Canada–India Comprehensive Economic Partnership Agreement, Canada–United Arab Emirates Comprehensive Economic Partnership Agreement, Canada–Thailand Free Trade Agreement, and Canada–Mercosur Free Trade Agreement. Input from stakeholders will help shape Canada’s negotiating positions, with submissions open until January 27, 2026.

WILL YOUR ROOMBA STILL CLEAN YOUR HOME AFTER THIS?

Do you own a Roomba? I got my grandma a J7+ last Christmas.

But tough news! iRobot, the company that makes your robot vacuum, has filed for bankruptcy and will go private after being bought by its main manufacturer, Shenzhen-based Picea Robotics. iRobot generated about $682 million in revenue in 2024 but has faced several challenges, including increased competition from cheaper Chinese brands, rising inflation, and high tariffs imposed during the Trump administration.

Most of iRobot’s devices are manufactured in Vietnam, where imports face a 46% U.S. tariff. And court records obtained by Chapter 49 show that iRobot owed over $3 million in unpaid tariffs.

But what really caused iRobot’s downfall?

Some of my friends say it’s because the company lost the innovation race. Which I don’t agree. Its Roomba models, like the J7+ and Max 705, are still popular.

According to TechCrunch, iRobot’s struggles were tied to supply chain challenges, financial pressures, and strategic ventures outside its core business. Its heavy reliance on Shenzhen-based PICEA Robotics as its main supplier left production exposed to global logistics disruptions and rising costs. Investing in non-core ventures and other strategic decisions reduced iRobot’s flexibility, making it harder to compete with cheaper alternatives and handle market pressures.

So…tariffs aren’t the whole story. They were just the final nail in the coffin.

But it’s a good reminder that tariffs affect margins, especially for products with complex global supply chains. Which is why businesses need to monitor trade policies closely, plan shipping routes strategically, manage pricing carefully, and diversify sourcing instead of relying on a single route.

Anyway, back to your Roomba! Don’t worry! It will continue working as usual, with no changes to features or programs, according to the company’s PR.

IS $1B REALLY A WIN?

CBP said this week it has collected more than $1B in duties since phasing out the de minimis exemption, and that looks impressive at first glance. Low-value shipments that once entered the U.S. duty-free now generate revenue.

For Trump’s admin, it’s a win. But for trade professionals, it’s a reset with a few headaches attached. Duties add up on small-value products, and these costs move downstream. They move into pricing, delivery timelines, and inventory decisions. For smaller sellers, even modest duties and fees can erase margins on low-priced goods.

It also leads to more compliance work for brokers and carriers. Major carriers like UPS report that daily packages needing customs clearance jumped from 13,000 to over 112,000, with 10% needing manual checks due to missing or incorrect documentation.

Soon enough, the system may stabilize. But for now, the end of de minimis looks less like a clear win and more like a broad reset with real trade-offs for many importers, especially small businesses.

GPS FOR YOUR NEXT TRADE CAREER!

Five companies are hiring trade pros in Chicago right now!

How did we know it? The GlobalTradeJobs.com job board provides the fastest route to your next role, which is why we call it “the GPS for global trade careers”.

Focused just on trade, logistics, and supply chain jobs, it helps you find roles that match your skills fast. Set up alerts, explore company profiles, and apply easily.

Start your career route today at GlobalTradeJobs.com.

Source: Global Trade Jobs

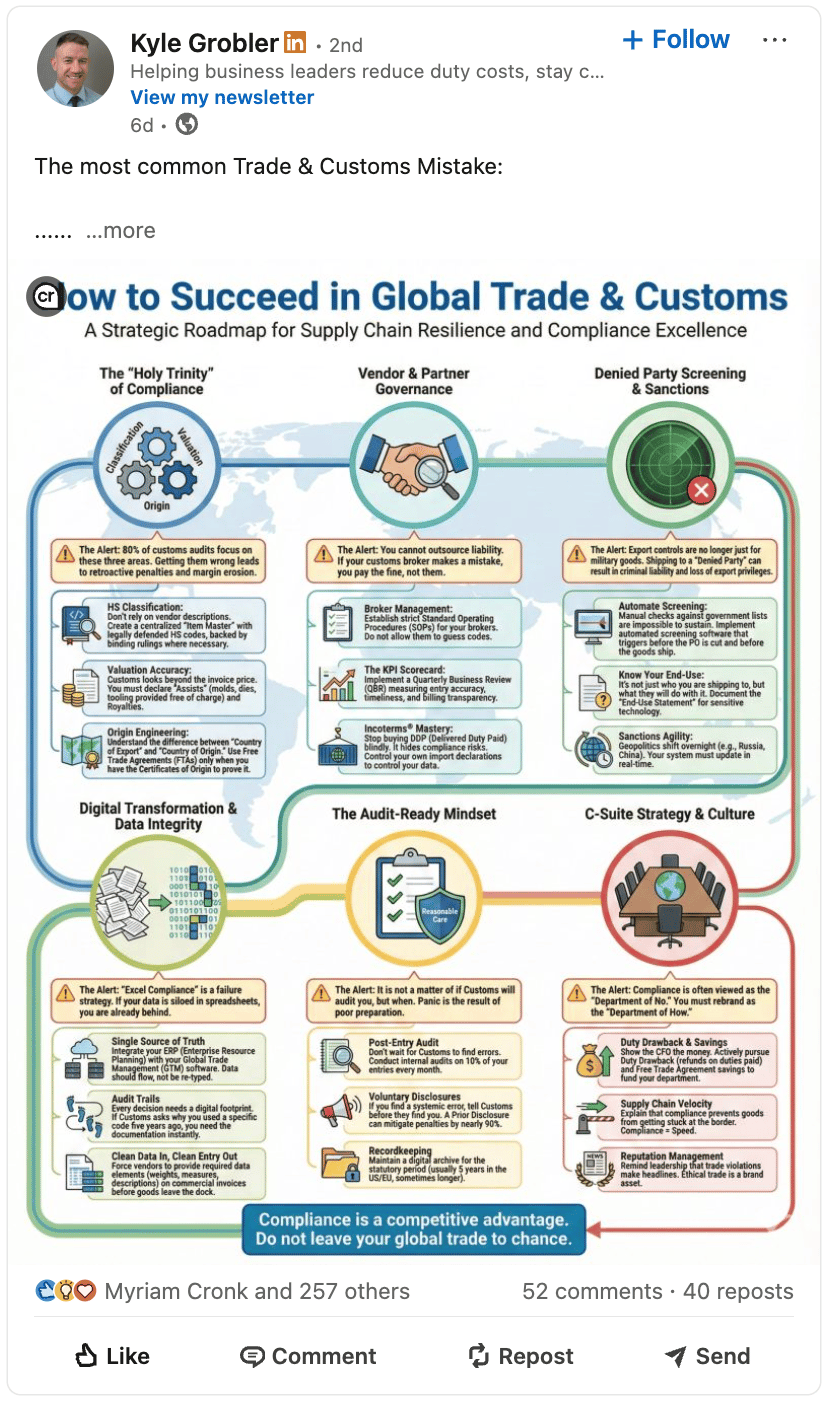

HOLY TRINITY OF GLOBAL TRADE

Get all these 3 right: HS Classification, Valuation, and Country of Origin. Because these are what Kyle Grobler, a global trade compliance expert, calls the Holy Trinity in his LinkedIn post.

Kyle Grober shares that the most common trade and customs mistakes come from too many unread policies, glorifying firefighting, and assuming temporary fixes are enough.

His cheat sheet? The Holy Trinity, Vendor & Partner Governance, Denied Party Screening, Digital & Data Integrity, an Audit-Ready Mindset, and C-Suite Buy-In to protect margins, reputation, and the supply chain.

Check Kyle’s post to see his full cheat sheet, and follow him on LinkedIn for more trade insights.

Source: Kyle Grobler (LinkedIn)

Love what you read? Explore our latest stories!

Have a story or insights to share? Pitch it to us!

Got this from a friend? Join our mailing list!